Office Rental Prices in Ho Chi Minh City & Hanoi, Vietnam

Office rental prices in Ho Chi Minh City and Hanoi have become a key concern for businesses seeking to establish or expand operations in Vietnam. As the two largest economic hubs, these cities offer diverse office options – from Grade A buildings in central districts, well-equipped Grade B offices to affordable shared and serviced offices. However, rental rates vary significantly depending on location, building class, and market demand, reflecting broader economic and investment trends in each city.

|

|

Table of Contents

1. Office Rental Prices in Ho Chi Minh City

1.1 Market Overview

As the largest economic center in Vietnam, the office rental market in Ho Chi Minh City is experiencing continuous and strong growth. With the presence of many multinational companies and startups, the demand for high-quality office space is steadily increasing. District 1 and District 7 stand out as key areas, attracting businesses thanks to their strategic locations and modern infrastructure. Outside the central districts, many businesses are seeking offices in nearby areas such as Binh Thanh, Phu Nhuan and Thu Duc to optimize costs while still ensuring convenient locations.

In the first three months of 2025, the total office floor area supply in Ho Chi Minh City reached approximately 1.64 million m2, with new supply near the airport adding nearly 5,000 m2 to the market. However, the supply of Grade A office space in the city center is scarce, causing office rental prices in Ho Chi Minh City to rise slightly.

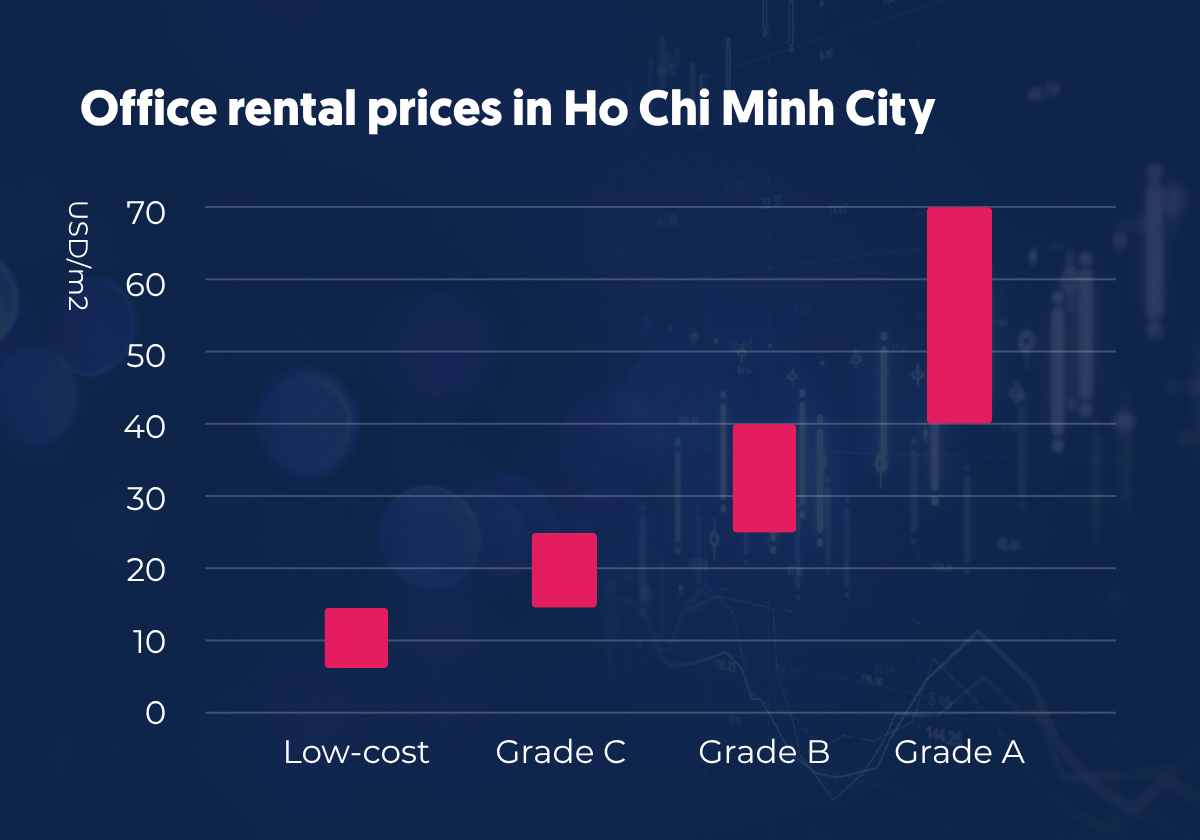

1.2 Average Rental Rates by Office Grade

The cost of office space in Ho Chi Minh City varies significantly depending on the office grade. Prices range from $6 – $70/m2/month and are divided into 04 segments:

LATEST OFFICE RENTAL PRICES IN HO CHI MINH CITY

| Office Rent Grade | Rental Price |

| Grade A Office in HCMC | $30 – $70/m2/month |

| Grade B Office in HCMC | $10 – $40/m2/month |

| Grade C Office in HCMC | $6 – $30/m2/month |

| Low-cost offices | Under $15/m2/month |

The difference in rental prices by office grade clearly reflects the location, amenities, and infrastructure quality of each area.

– Grade A offices: Mainly concentrated in the central areas of District 1 and District 3, they are the top choice for multinational corporations and large enterprises. This segment has the highest rental prices, offering modern spaces equipped with full premium amenities for tenants. Notable buildings include Bitexco Financial Tower, Vietcombank Tower, Deutsches Haus, The Nexus.

– Grade B offices: Commonly found in areas such as District 3, District 7, Phu Nhuan, or some newly developing areas like Thu Duc. These buildings typically offer basic amenities at more affordable prices, suitable for small and medium enterprises or startups looking to optimize costs while maintaining a professional working environment. Notable Grade B buildings include E.Town, AB Tower, CII Tower, Centre Point.

– Grade C offices: Typically located in suburban areas or older buildings with lower rental costs. This segment often lacks premium amenities but still meets the needs of small businesses, startups, or freelancers who prioritize cost savings. Well-known options include Saigon Coop Tower, Capital Building, IDC Building, TLM Building.

>> See more:

– Grade A Office Buildings in HCMC

– Grade B Office Buildings in HCMC

– Grade C Office Buildings in HCMC

1.3 Current Trends and Forecasts

The office rental market in Ho Chi Minh City is witnessing several notable trends, reflecting shifts in business needs and strategies. One prominent trend is the rising demand for flexible office spaces, such as serviced offices and co-working spaces. These types of offices appeal to startups, freelancers, and even large companies thanks to short-term lease options, reasonable costs, and modern amenities. According to Savills Vietnam, flexible spaces have reached an occupancy rate of over 80%, indicating strong demand as businesses seek greater flexibility to adapt to economic fluctuations.

Another emerging trend is the shift toward green office buildings with sustainability certifications such as LEED or WELL. Businesses are increasingly prioritizing environmental factors and employee well-being, leading them to choose energy-efficient buildings with natural lighting and user-friendly designs. This trend not only enhances corporate branding but also helps reduce long-term operating costs. In response, many investors in Ho Chi Minh City are actively incorporating green standards into new projects to meet this growing demand.

Looking ahead, office rental prices in Ho Chi Minh City are expected to remain stable in 2025, with slight growth in the Grade A segment due to limited new supply in the central business district. The eastern area, particularly Thu Thiem, is emerging as a new business hub with projects like The Hallmark and The Nexus. These developments are expected to attract technology and e-commerce companies thanks to their strong transport connectivity to the city center.

However, the market also faces challenges, as the increase in new supply may put pressure on occupancy rates and rental prices, particularly in non-central areas. In addition, many businesses are optimizing their workspace through hybrid work, reducing the demand for large office spaces. Nevertheless, with strong development of transportation infrastructure such as metro lines and policies attracting foreign investment, Ho Chi Minh City is still considered an attractive destination for the office market, expected to maintain stable growth until 2030.

2. Office Rental Prices in Hanoi

2.1 Market Overview

The office rental market in Hanoi has shown stable growth in recent years, reflecting the city’s economic development and its ability to attract foreign investment. The office rental market in Hanoi has shown stable growth in recent years, reflecting the city’s economic development and its ability to attract foreign investment. According to Cushman & Wakefield, as of Q1/2025, the total supply of Grade A and B office space in Hanoi reached approximately 1.67 million m2. The occupancy rate for Grade A offices remained stable at nearly 75%, while Grade B offices reached around 85%, showing a slight increase compared to the same period last year.

The supply of Grade A office space in central business districts (CBD) such as Hoan Kiem and Ba Dinh remains limited, putting upward pressure on rental prices, while peripheral areas like Cau Giay and Nam Tu Liem offer more affordable options.

>> Top 6 Modern Office Buildings to Explore in Non-CBD Areas

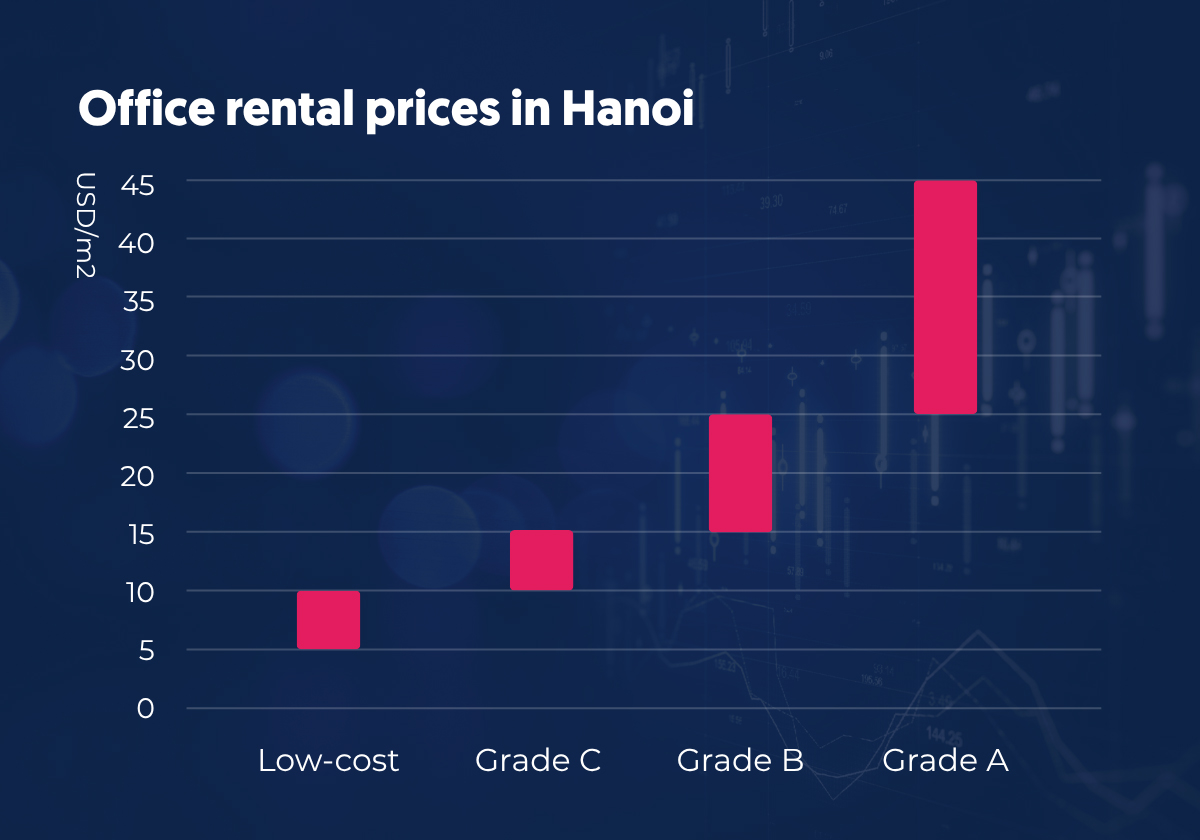

2.2 Average Rental Rates by Office Grade

Office rental prices in Hanoi are clearly segmented by office grade, reflecting the quality of the building, location, and accompanying services. The common categories include Grade A, B, C, and low-cost offices, with prices ranging from $10 – $40/m2/month, divided into 04 segments:

LATEST OFFICE RENTAL PRICES IN HANOI

| Office Rent Grade | Rental Price |

| Grade A Office in Hanoi | $25 – $40/m2/month |

| Grade B Office in Hanoi | $15 – $25/m2/month |

| Grade C Office in Hanoi | $10 – $15/m2/month |

| Low-cost offices in Hanoi | Under $10/m2/month |

Office rental prices and quality in Hanoi vary significantly depending on location, available amenities, and the level of investment in each area.

– Grade A offices: These are concentrated in central districts such as Hoan Kiem, Ba Dinh, and Cau Giay, where many embassies, international organizations, and multinational companies are located. Rental prices in this segment are the highest in the market, corresponding to the building quality, modern equipment, security systems, and professional management. Notable projects include Keangnam Landmark Tower, Lotte Mall West Lake Hanoi, Hanoi Tower, Capital Place, BRG Tower.

– Grade B offices: This segment is largely concentrated in districts such as Cau Giay, Nam Tu Liem, and Dong Da. It is a popular choice for small and medium-sized enterprises, tech companies, and startups. The buildings typically offer good infrastructure without being overly luxurious, and rental costs are moderate. Notable buildings include VCCI Tower, Peakview Tower, The West Tower, Thai Nam Building, Pearl Tower.

– Grade C offices: This segment is mainly found in suburban areas such as Thanh Xuan, Ha Dong, or in older buildings located in central districts. Rental prices are generally low, accompanied by basic facilities that still meet essential working needs. These offices are suitable for small businesses, freelancer groups, or newly established startups looking to minimize operational costs.

The average rental price for Grade A offices saw a slight increase of 2.2% compared to the previous quarter and 1.7% year-on-year, mainly driven by rental adjustments in buildings located in central areas. In contrast, the Grade B segment experienced a decline in rental rates both quarterly and annually, as landlords offered attractive incentives and adopted flexible pricing strategies to attract tenants amid rising supply (Source: Cushman & Wakefield).

>> See more:

– Grade A Office Buildings in Hanoi

– Grade B Office Buildings in Hanoi

– Grade C Office Buildings in Hanoi

2.3 Current Trends and Forecasts

Outside the central area of Ba Dinh and Hoan Kiem, businesses are increasingly expanding to districts like Cau Giay, Nam Tu Liem, Long Bien – where many new office buildings offer competitive rental rates and well-developed infrastructure. In particular, Hanoi’s western area (My Dinh – Cau Giay – Nam Tu Liem) is emerging as a key hub, with numerous well-planned office projects, convenient transportation links, and proximity to high-end residential zones.

Facing increasing competition in Hanoi’s office market, many developers are prioritizing the construction of new office projects with modern designs, integrated technology, and compliance with international green standards. Projects certified with LEED or EDGE are gaining popularity as both tenants and investors place greater emphasis on environmental factors, operational efficiency, and long-term asset value. This approach not only serves as a strategy to attract high-quality tenants but also demonstrates a strong commitment to sustainable development in line with global trends.

In 2026, office rental prices in Hanoi are expected to remain stable, with a slight increase likely in the Grade A segment due to limited supply in the city center. Meanwhile, Grade B and C offices may face slight downward pressure on rental rates as new supply continues to enter the market. However, economic recovery and ongoing inflows of foreign direct investment (FDI) are anticipated to support stable occupancy rates and sustained office demand over the long term.

3. Factors Affecting Office Rental Prices in Vietnam

Vietnam office rental prices are influenced by various factors, reflecting the fluctuations of the real estate market and broader economic development trends. Key elements such as location, building quality, transportation infrastructure, incentives policies, and lease terms all play a crucial role in shaping rental rates.

3.1 Building grade and facilities

The building grade (A, B, C) reflects the level of modernity, construction quality, available facilities, and is also a key factor directly affecting rental prices. Buildings with modern infrastructure and green building certifications such as LEED, EDGE or WELL command higher rental prices as they meet the demands of international companies and large corporations. Additionally, premium amenities like smart parking, green spaces, or intelligent building management systems can increase office rental prices in Vietnam by 20 – 30% compared to buildings offering only basic facilities.

3.2 Location, accessibility, and foot traffic

Location is one of the most important factors affecting office rental prices in Vietnam. Offices in central business districts (CBD) usually have the highest rental rates due to their proximity to financial and commercial centers and high foot traffic, facilitating business operations. Additionally, office buildings near metro stations or main roads often command higher rents because of convenient transportation.

3.3 Lease term, incentives, and management fees

Lease terms, incentive policies, and management fees are other important factors affecting Vietnam office rental prices.

– Lease term: Long-term leases are often offered at better rates by landlords to ensure stable revenue and reduce the risk of finding new tenants. In contrast, short-term leases may have higher prices due to their flexibility but usually come with more restrictions.

– Incentive policies: Incentives such as the first month free, discounted rent during the initial period, or support for office renovations are strategies landlords use to attract and retain tenants. These incentives can reduce upfront costs for businesses, making it easier for them to decide to lease.

– Management fees: This fee covers maintenance, security, cleaning services, and common amenities within the building. High-end buildings usually have higher management fees but offer better service quality, creating a professional and comfortable working environment for tenants. Careful consideration of these fees helps businesses manage their budgets more effectively.

Office rental prices in Ho Chi Minh City and Hanoi are influenced by various factors such as location, building grade, market trends, and leasing policies. Despite differences in price levels and supply, both cities remain highly attractive to domestic and foreign businesses. With ongoing infrastructure and economic development, the office markets in these two major cities are expected to remain stable and continue growing in the coming years.

Editor and content team manager at Maison Office.

With over 5 years of experience in consulting and extensive content editing in the real estate services and interior design field. Sharing valuable information with customers, partners, and attracting millions of views.