Deposit and Payment Terms for Office Leasing in Vietnam

Deposit and payment terms office leasing Vietnam are crucial aspects that require careful attention in the contract. These terms directly affect the company’s cash flow and indicate the level of commitment between the tenant and the landlord. Understanding regulations regarding the deposit amount, payment schedule, and payment methods helps businesses negotiate effectively and manage operations more proactively.

Table of Contents

1. Office Lease Deposit Terms in Vietnam

Office lease deposit Vietnam serves as a financial security measure for both landlords and tenants. To ensure a smooth leasing process, businesses need to understand the purpose of the deposit, the standard deposit amount, refund conditions, and non-refundable cases. These factors have a direct impact on financial planning and risk management throughout the lease term.

1.1 Purpose of the Deposit

The office lease deposit Vietnam plays an important role as a financial security measure, helping to balance the interests of both the landlord and the tenant. It is an upfront payment made by the tenant to the landlord to ensure fulfillment of financial obligations and responsibilities as outlined in the lease agreement.

The main purposes of the deposit include:

– Payment security: One of the most common risks is that tenants may fail to pay rent on time or in full during the lease term. This can significantly impact the landlord, especially when they must cover operational and maintenance costs. In such cases, the deposit serves as a “reserve fund” that the landlord can use if the tenant breaches their payment obligations.

– Damage compensation: The deposit also serves as compensation in case the tenant causes damage to the property or office facilities. If any damage occurs due to the tenant’s fault during the lease term, the landlord has the right to deduct the repair costs from the deposit without needing to claim additional charges. This helps minimize potential disputes later on.

– Contract performance commitment: The deposit also serves as a form of commitment from the tenant to fulfill the lease agreement. Requiring a relatively large upfront payment encourages tenants to carefully consider their decision before signing and shows their seriousness in maintaining the lease. If the tenant unilaterally terminates the contract without a legitimate reason, the deposit may be partially or fully forfeited as a penalty.

– Allowing tenants to secure their space: In today’s competitive office market, finding a suitable space with the desired location, size, and price is not always easy. The deposit helps tenants hold the space while waiting to sign the official contract or complete legal procedures, as well as office design and renovation according to their specific requirements.

By clearly understanding the purpose of the deposit, businesses can better prepare for contract negotiations and manage risks effectively.

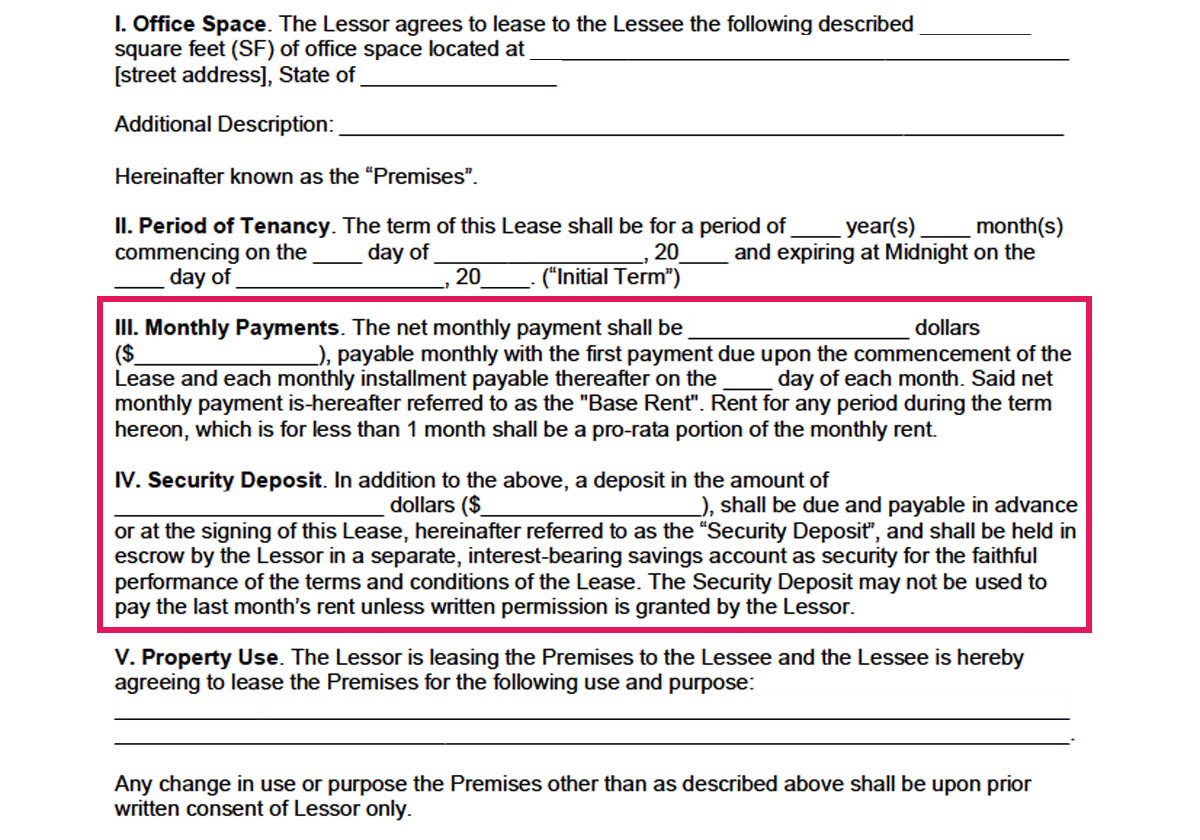

1.2 Standard Deposit Amount

In Vietnam’s office leasing market, the deposit amount is a key factor that reflects the level of financial risk faced by landlords as well as market conditions. The standard deposit typically ranges from 1 to 3 months’ rent, depending on various factors such as location, office type, lease term, and mutual agreements between the parties.

In major cities like Ho Chi Minh City and Hanoi, where many Grade A and B office buildings are concentrated, landlords often require higher deposit amounts – typically equivalent to 3 months’ rent. This is especially common for offices located in central areas such as District 1, District 3 (HCMC) or Hoan Kiem District, Ba Dinh District (Hanoi). This high deposit requirement reflects the premium value of these properties and strong demand from multinational corporations or large enterprises that are willing to pay a premium for strategic locations.

Conversely, in suburban areas or for Grade C offices and spaces in smaller buildings, the required deposit is typically lower – typically equivalent to 1 month’s rent. This lower deposit is more suitable for small and medium-sized enterprises (SMEs) or startups with limited budgets.

–> For example: In a lease contract for a Grade C office with a monthly rent of 10 million VND, the typical deposit ranges from 10 to 20 million VND (equivalent to 1 – 2 months’ rent).

1.3 Refund Terms

In office lease agreements in Vietnam, the deposit refund terms are a crucial element to ensure that the rights of both tenants and landlords are enforced transparently and fairly. These terms not only specify the timeline and refund process but also outline the responsibilities the tenant must fulfill to receive the full deposit back at the end of the lease.

According to common practice in Vietnam, the deposit is usually refunded within 15 to 30 days after the lease ends, provided that the tenant meets all conditions stated in the contract. The exact time frame depends on the agreement between both parties and is typically detailed in the lease terms. To receive the deposit refund, tenants must meet the following key conditions:

– Full payment of all fees: The tenant must have settled all rent payments, utility bills (electricity, water, internet), and any other charges such as building management or service fees during the lease period.

– Preservation of property condition: The office must be returned in good condition, with no significant damage beyond normal wear and tear. Damages such as broken glass doors, malfunctioning air-conditioning systems, or unauthorized structural changes may result in deductions from the deposit.

– Compliance with contract terms: The tenant must adhere to the lease terms, including proper notice of termination – typically 30 to 60 days before the lease ends.

By clearly understanding this process and preparing carefully, businesses can ensure they receive the full deposit refund while maintaining a positive relationship with the landlord in an increasingly competitive office leasing market.

1.4 Non-Refundable Cases

The security deposit serves as a financial safeguard for the landlord in office lease agreements and is typically refunded to the tenant upon the conclusion of the lease. However, in certain specific cases, all or part of the deposit may not be refunded. Common situations include:

– Early termination: If the tenant ends the lease before its agreed term without following the notice period requirements or without a valid reason stated in the contract, the landlord may retain all or part of the deposit. This is intended to compensate for the lost rental income during the time needed to find a new tenant.

– Property damage: If the tenant causes significant damage to the office beyond normal wear and tear, the landlord may deduct repair costs from the deposit. Such damages may include broken glass doors, structural damage to walls, ceilings, or floors, and damage to equipment or fixtures.

– Unpaid debts: During the lease period, if the tenant fails to fulfill financial obligations such as monthly rent, utility bills or other incurred charges, the landlord has the right to retain part or all of the deposit to offset these outstanding debts.

2. Rental Payment Terms and Common Practices

Payment terms for office rental in Vietnam are one of the key elements that directly impact a company’s budget and financial planning. Therefore, businesses need to clearly understand common practices regarding payment schedules, payment methods, and regulations for handling late payments to ensure contract compliance and avoid unnecessary disputes.

2.1 Payment Frequency and Methods

Payment frequency and methods refer to how often the rent is paid during the contract term and the manner in which the payment is made. The payment frequency for office rentals in Vietnam is typically negotiated based on the tenant’s needs and the landlord’s policies. Monthly payments are the most common, especially for short-term leases (under 2 years) or small businesses. For long-term contracts or premium office spaces, landlords may require quarterly or even annual payments to reduce financial risk and administrative costs.

In terms of payment methods, bank transfers are the most common choice due to their transparency and convenience, especially in Grade A and B office buildings managed by professional firms. Some landlords may still accept cash, but this is becoming increasingly rare due to VAT invoice requirements and financial transparency. Additionally, some contracts allow payment via letter of credit or bank guarantee for large enterprises with long-term leases, ensuring timely and secure payments.

2.2 Due Dates and Late Penalties

Office rent due dates are typically clearly defined in the lease agreement, based on the agreed payment frequency (monthly, quarterly, or annually). The most common practice is requiring payment between the 1st and 5th of the month for monthly payment terms. For quarterly payments, the deadline usually falls within the first 5 to 10 days of the quarter. Some landlords may offer more flexibility, allowing late payments within 7 to 10 days after the due date, but this must be pre-agreed and clearly stated in the contract.

Late payment penalties are a common practice in office lease contracts in Vietnam, designed to ensure tenants fulfill their payment obligations on time. These penalties are usually calculated as a daily interest rate on the overdue amount – commonly ranging from 0.05% to 0.2% per day.

–> For example: If a company rents an office in Hanoi for 15 million VND/month and is 10 days late in payment, with the contract stipulating a penalty of 0.2% per day, the late fee would be: 15,000,000 * 0.2% * 10 = 300,000 VND.

In some cases, repeated late payments may lead to further consequences, such as temporarily suspending the tenant’s right to use the office, contract termination or forfeiture of the security deposit.

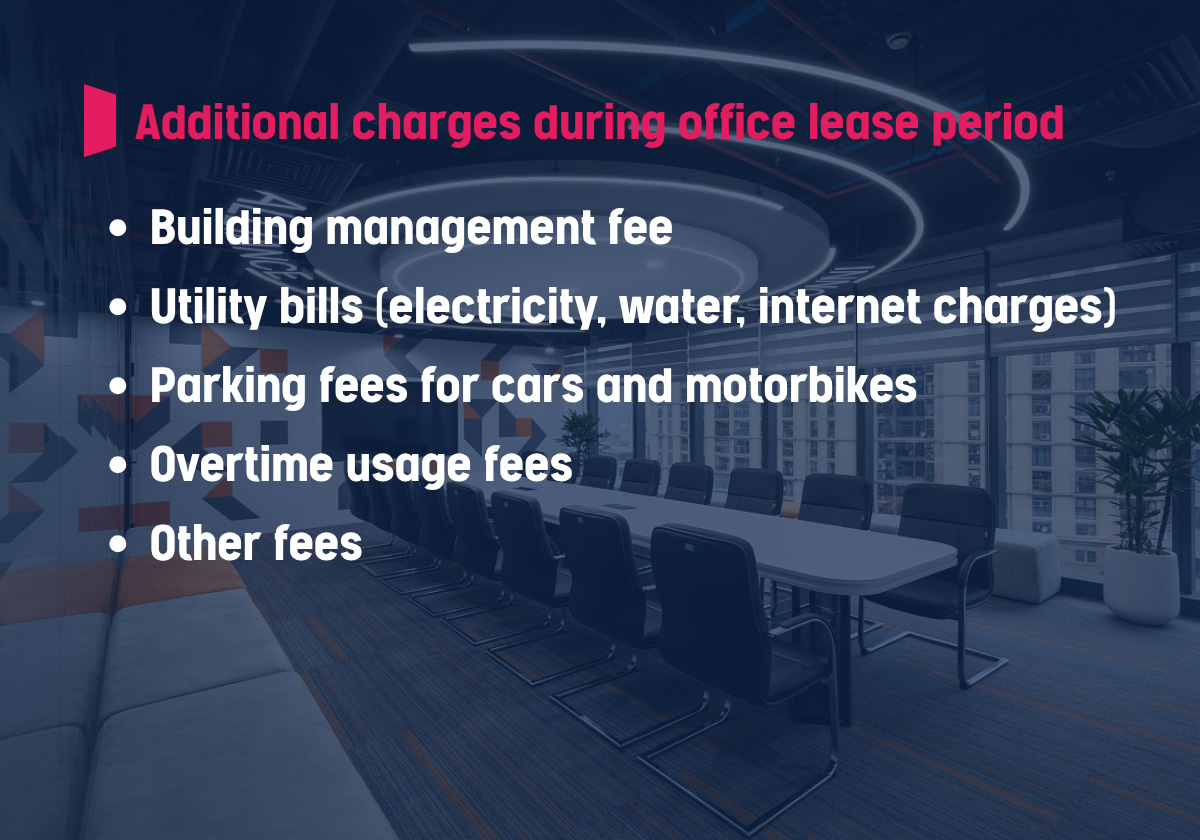

2.3 Additional Charges

In addition to the base rent, tenants are often required to pay additional charges to maintain the building’s service quality. These fees not only impact the total rental cost but also reflect the level of convenience and professionalism of the office space. Clearly understanding the types of additional charges, how they are calculated, and how to manage them is essential for businesses to plan their finances effectively.

Common types of additional charges include:

– Building Management Fee: This is the most common charge, covering expenses for operations, maintenance, cleaning, security, and shared utilities such as elevators, central air conditioning, and common areas.

– Utility Bills: Electricity, water, and internet charges are typically calculated separately based on meter readings or actual usage. Air conditioning costs are often the largest utility expense.

– Parking Fees: In major cities like Ho Chi Minh City and Hanoi, parking is a significant cost due to limited space. Fees usually range from 1 – 3 million VND/month per car and 100,000 – 300,000 VND/month per motorbike.

– Overtime Usage Fees: If tenants use the office outside of normal business hours (typically after 6:00 PM or on weekends), landlords may charge overtime fees to cover electricity, air conditioning, and security services.

2.4 Variations by Building Grade (A, B, C)

Payment terms for office rental in Vietnam vary significantly depending on the building Grade (A, B, or C), reflecting the differences in quality, location, and services offered by each type.

– Grade A buildings: Operated by professional management firms and primarily serving large enterprises or multinational companies, these buildings often impose stricter payment requirements. Tenants are typically required to pay quarterly or annually via bank transfer, and in some cases, provide a bank guarantee letter.

– Grade B buildings: With a moderate level of professionalism and a more diverse tenant base, payment terms are generally more flexible. Tenants may pay monthly or quarterly, mainly via bank transfer, and there is usually more room for negotiation compared to Grade A buildings.

– Grade C buildings or small offices: Typically owned and operated by individual landlords, these properties often come with simpler terms. Monthly payments are common, and some landlords may still accept cash. However, businesses should exercise caution, as legal and financial risks may be higher (e.g., lack of VAT invoices, poorly defined contract terms).

>> See more: What is Grade A Office Space? Building Classification Types

3. Key Considerations When Negotiating Office Lease Contracts

Negotiating an office lease contract is a critical step to ensure the business secures optimal terms in cost, conditions, and flexibility. This section analyzes key considerations when negotiating office lease contracts, offering practical guidance for businesses to protect their interests in a competitive market.

3.1 Clarify Payment and Deposit Terms in Writing

To avoid misunderstandings and disputes between both parties, all deposit and payment terms office leasing in Vietnam must be clearly stated in the contract. This includes the payment frequency (monthly, quarterly), payment methods (bank transfer, cash), payment schedules, and late payment penalties. At the same time, conditions related to the security deposit and its refund must also be clearly specified, providing a solid legal basis to ensure a transparent leasing process.

3.2 Request Separate Invoices for Rent and Service Charges

To facilitate accurate financial management and tax compliance, businesses should request landlords to issue separate invoices for office rent and associated management and utility fees. Separating invoices helps businesses better control expenses and allocate budgets clearly, while ensuring transparency during VAT declaration. Additionally, separate invoices make it easier to reconcile and resolve any payment disputes, avoiding confusion between different cost items in the lease contract.

>> See more: How to Account for Office Rent Expenses [New Regulations]

3.3 Negotiate Reduced Deposit for Long-Term Leases

The security deposit often creates a significant initial financial burden for businesses, especially small and medium enterprises or startups with limited capital. This amount usually ranges from 1 to 3 months’ rent, and can be even higher for Grade A offices or those in prime locations. However, with long-term leases, tenants have the opportunity to negotiate a reduction in the number of deposit months or seek more flexible refund conditions. This not only helps improve cash flow but also reduces initial financial pressure, creating more favorable conditions for businesses to focus on their core operations.

Additionally, it contributes to building a trustworthy and long-term relationship between tenants and landlords, supporting stability throughout the lease period. Therefore, careful preparation and proactive negotiation of the deposit are crucial factors for businesses to manage their finances effectively when renting office space.

3.4 Legal Review and Risk Mitigation

Businesses should engage an experienced lawyer or legal expert to thoroughly review the office lease agreement before signing. This is especially important when dealing with complex deposit and payment terms in office leasing in Vietnam, as unclear or unfavorable clauses can lead to legal disputes.

A legal professional can help identify potential risks and recommend appropriate revisions to ensure the contract balances the interests of both parties and complies with current legal regulations. Doing so not only minimizes the risk of legal conflicts but also safeguards the business’s long-term rights and interests of the business throughout the lease term.

In conclusion, deposit and payment terms for office leasing in Vietnam play a vital role in shaping the financial and operational stability of a business. A Clear understanding and careful negotiation of these terms are essential to avoid unexpected costs and legal disputes. Businesses that invest time in reviewing contracts and seeking expert advice are better positioned to secure flexible, fair, and sustainable leasing arrangements in Vietnam’s office rental market.

>> See more: Understanding what a lease entails is crucial for defining payment responsibilities and commitment levels.

Editor and content team manager at Maison Office.

With over 5 years of experience in consulting and extensive content editing in the real estate services and interior design field. Sharing valuable information with customers, partners, and attracting millions of views.