HCMC Office Leasing Market Outlook 2026

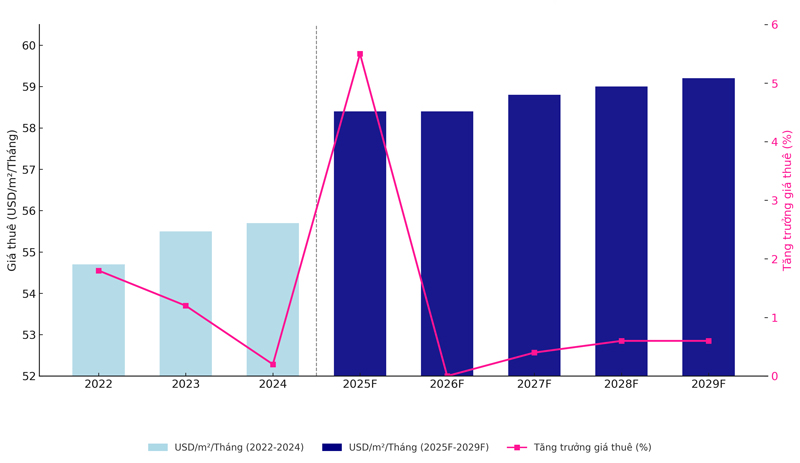

The office leasing market in Ho Chi Minh City is entering a rebalancing phase, driven by increasing supply and noticeable adjustments in corporate workplace strategies. From 2026 onward, rental rates are expected to remain largely stable, with only marginal growth of approximately 0.4–0.5% per annum. At the same time, tenant demand is increasingly shifting toward flexible office models, cost-efficient solutions, and locations outside the CBD, prompting businesses to reassess and restructure their office strategies with a stronger focus on operational efficiency and long-term sustainability.

See more: Hanoi Office Leasing Market Outlook 2026

|

|

Table of Contents

1. Overview of the Ho Chi Minh City Office Leasing Market in 2025

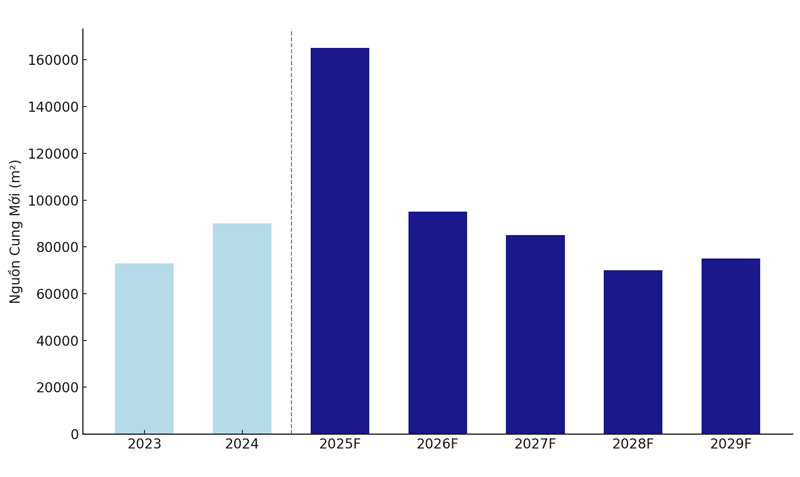

2025 marks a pivotal transition phase for the Ho Chi Minh City office market, as a significant wave of new supply enters the market following the recovery cycle of 2023–2024. Grade A office space continues to be added across the expanded CBD and emerging urban districts, placing moderate pressure on occupancy levels.

Against this backdrop, rental rates have remained largely stable, with slower growth compared to previous years, while landlords have adopted more flexible incentive packages to attract tenants. Leasing demand continues to be driven by technology, finance, pharmaceuticals, and FDI-backed enterprises, alongside a clear shift toward higher-quality, green-certified offices and flexible workplace models. These dynamics are laying the groundwork for a broader market rebalancing phase beginning in 2026.

2. Potential for the Development of the Ho Chi Minh City Office Market

Entering 2026, the Ho Chi Minh City office market is shifting away from the rapid growth momentum seen during 2024–2025 toward a more stable and selective phase. Leasing demand remains supported by both domestic and international occupiers, particularly FDI-driven enterprises, technology, finance, and high-value service sectors. However, expansion strategies have evolved significantly, with tenants placing greater emphasis on space efficiency, cost control, and operational flexibility rather than pure scale growth.

The market outlook for 2026 is shaped by a substantial volume of supply delivered in previous years, alongside a clear shift in tenant behavior. Elevated vacancy levels allow occupiers to access higher-quality office buildings at more competitive budgets, while also strengthening their negotiating position on lease terms. Newly developed offices with green certifications and integrated modern amenities continue to attract strong interest, especially from companies prioritizing corporate branding and employee experience.

In parallel, ongoing improvements in transport infrastructure – most notably Metro Line 1 – are reinforcing connectivity and accelerating the development of non-CBD locations such as Thu Duc City and District 7.

This spatial shift is expanding location and leasing model options for occupiers, contributing to the transformation of the Ho Chi Minh City office market toward greater flexibility, sustainability, and a stronger focus on operational efficiency over the medium to long term.

3. Forecast for the Ho Chi Minh City Office Market in 2026

In 2026, the Ho Chi Minh City office market enters a more stable and clearly segmented phase, as a substantial volume of supply has already been delivered in previous years and tenant behavior continues to shift toward a more cautious and flexible approach. Factors such as location, building quality, operating model, and cost-efficiency are expected to play a decisive role in determining the competitiveness of each market segment.

3.1 New Supply Trends

Office supply in 2026 will primarily be driven by projects that were completed or entered the market during the 2024–2025 period, with a strong concentration in the extended CBD and newly developed urban areas. Grade A and B+ office buildings continue to account for a significant share of the supply, featuring higher construction standards, increased emphasis on green design, energy efficiency, and integrated amenities.

The increase in supply during previous years has resulted in a highly competitive market environment in 2026, particularly in non-CBD locations. This dynamic is pushing landlords to place greater emphasis on operational quality, flexible leasing policies, and value-added services in order to attract and retain tenants.

3.2 Tenant Demand and Preferences

Office demand in 2026 continues to be driven by FDI-backed companies, technology firms, financial institutions, pharmaceutical companies, and professional service providers. However, leasing objectives have evolved. Rather than prioritizing expansion at all costs, tenants are increasingly focused on space efficiency and long-term adaptability.

Tenant preferences are clearly shifting toward:

- Offices with flexible layouts that allow for easy subdivision or future expansion

- Buildings that meet green standards and place strong emphasis on employee health and workplace experience

- Coworking spaces, serviced offices, and flexible office models that reduce long-term lease commitments and enhance operational flexibility

3.3 Rental Prices and Market Competition

Office rental rates in Ho Chi Minh City in 2026 are expected to remain stable, with only marginal growth, reflecting competitive pressure from the existing supply. High-quality buildings with prime locations and efficient operations are likely to maintain stable rental levels, while older or less competitive properties may need to adjust their leasing strategies to remain attractive.

Market competition is becoming increasingly evident through more flexible commercial terms offered by landlords. Incentives such as rent-free periods, fit-out cost support, and flexible lease tenures are being applied more widely. At the same time, competition is no longer driven solely by headline rents but has expanded to include service quality, on-site amenities, and overall tenant experience – now key criteria in corporate office selection.

3.4 Technology and Future Office Models

Technology continues to play a central role in shaping the Ho Chi Minh City office market in 2026. New office developments, as well as upgraded existing buildings, are increasingly integrating smart building management solutions to optimize operations, including energy control systems, security, HVAC, and workspace management. The adoption of technology not only helps reduce operating costs but also enhances transparency, efficiency, and a building’s ability to adapt to evolving tenant requirements.

At the same time, the future office model in Ho Chi Minh City is being defined by flexibility and a people-centric approach. Workspaces are increasingly designed to support hybrid working models, with a greater emphasis on collaborative areas and a reduced proportion of fixed desks. Solutions that prioritize employee health, productivity, and workplace experience are becoming key decision-making criteria for tenants, while also serving as core competitive advantages for office buildings in the next phase of market development.

Overall, the Ho Chi Minh City office market in 2026 is transitioning into a phase of stability with selective competition, as supply remains elevated and rental growth stays modest. In this context, factors such as building quality, green standards, operational technology, and cost optimization capabilities are becoming increasingly decisive. Companies that proactively adapt to these trends and adopt flexible leasing strategies will be better positioned to control budgets and enhance long-term operational efficiency.

Explore prime office leasing opportunities in HCMC. Find the perfect workspace to elevate your business today. Discover Office for Lease in HCMC

Editor and content team manager at Maison Office.

With over 5 years of experience in consulting and extensive content editing in the real estate services and interior design field. Sharing valuable information with customers, partners, and attracting millions of views.