|

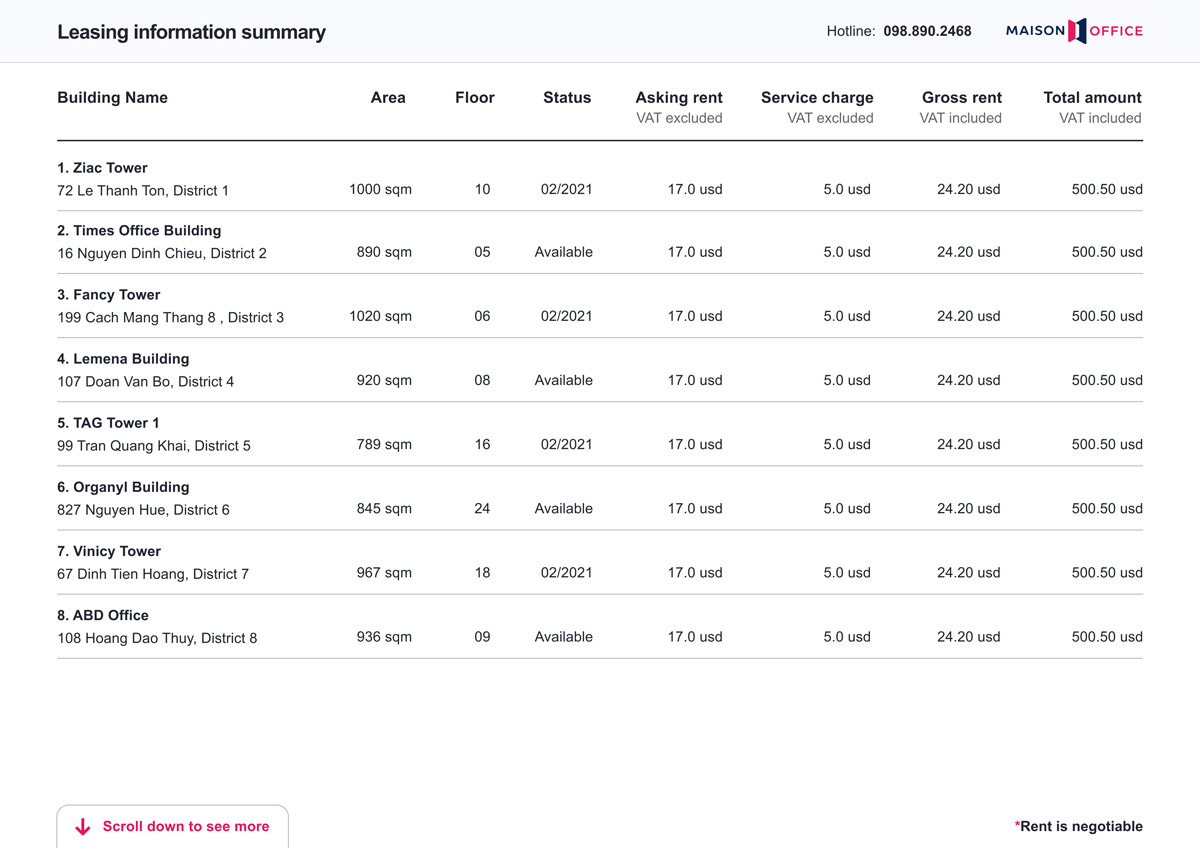

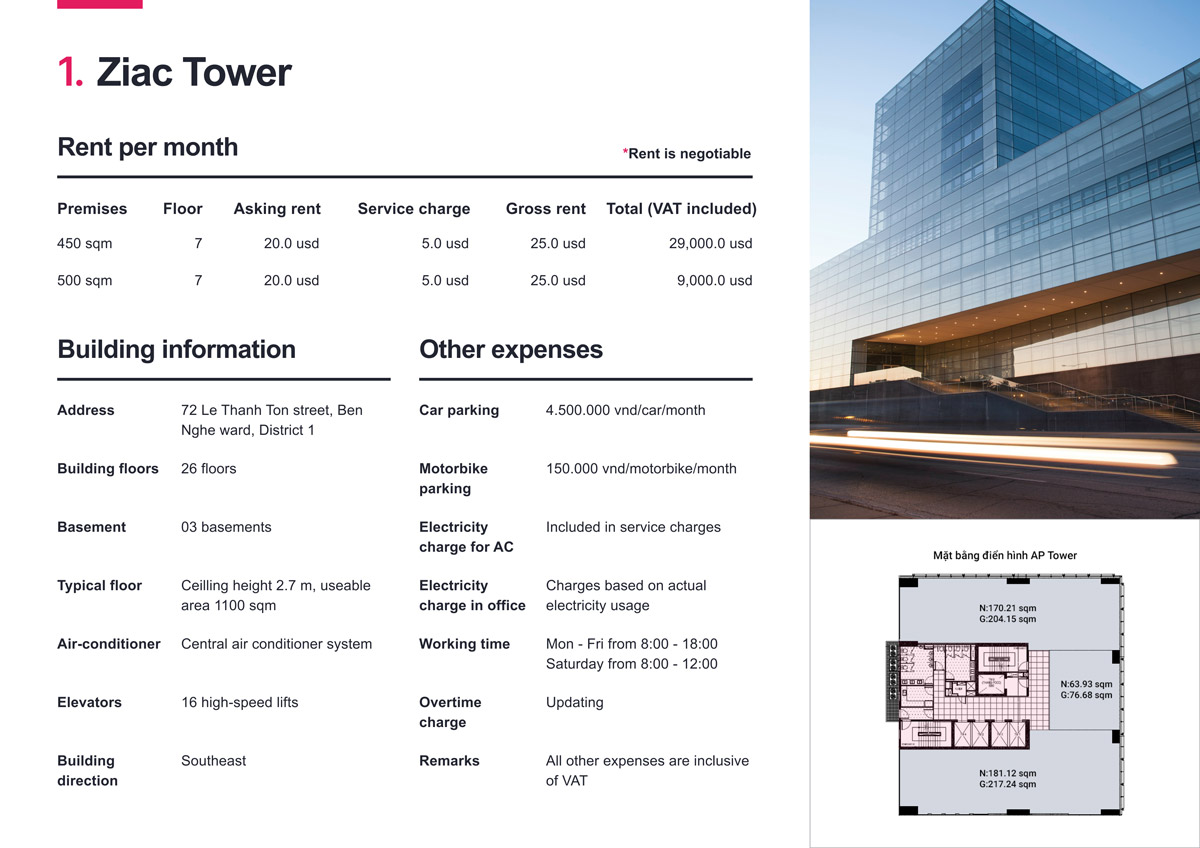

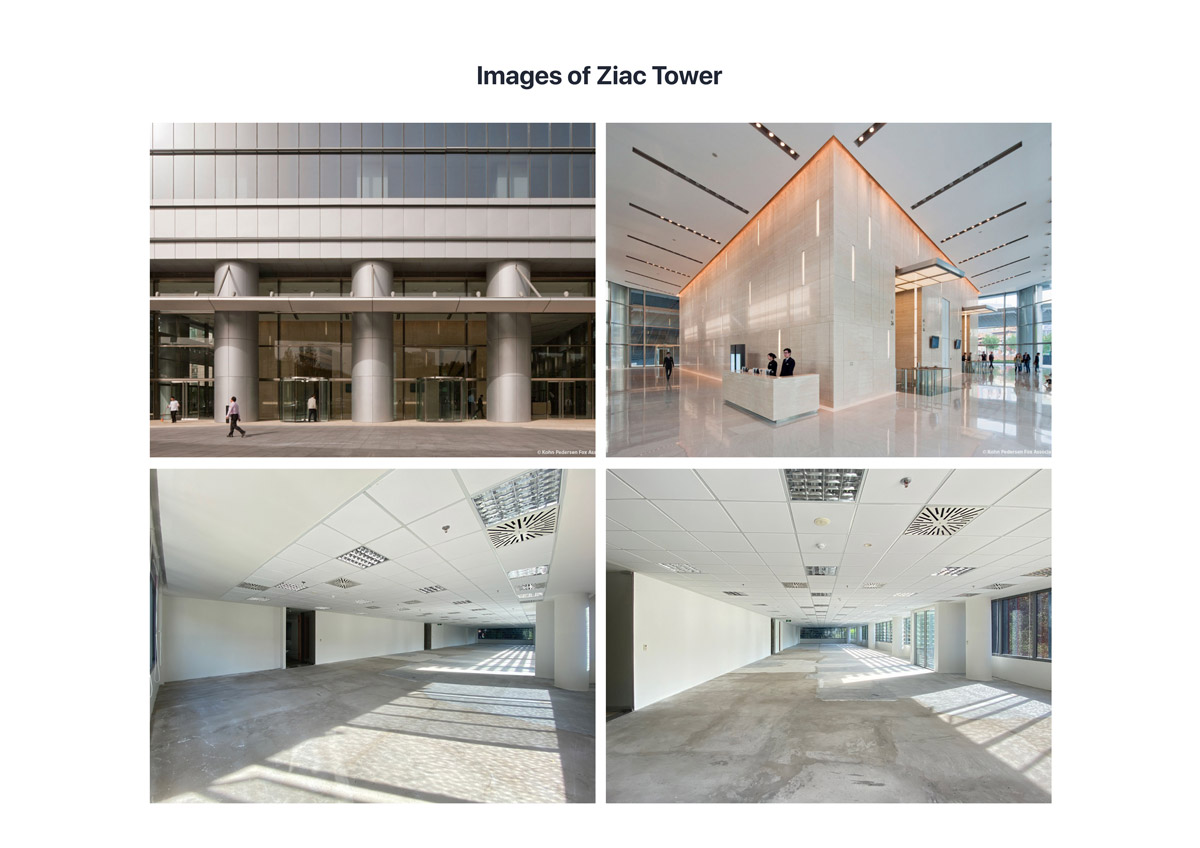

- Office for lease District 1

- Office for lease District 2

- Office for lease District 3

- Office for lease District 4

- Office for lease District 5

- Office for lease District 7

- Office for lease District 8

- Office for lease District 10

- Office for lease District 11

- Office for lease District 12

- Office for lease Binh Thanh

- Office for lease Phu Nhuan

- Office for lease Tan Binh

- Office for lease Go Vap

- Office for lease Thu Duc

- Types

- Grade A

- Grade B

- Grade C

- Economy office

|

- Office for lease Hoan Kiem

- Office for lease in Hai Ba Trung

- Office for lease Ba Dinh

- Office for lease Dong Da

- Office for lease Cau Giay

- Office for lease in Thanh Xuan

- Office for lease in Nam Tu Liem

- Office for lease in Bac Tu Liem

- Office for lease in Tay Ho

- Office for lease in Long Bien

- Office for lease in Ha Dong

- Office for lease in Hoang Mai

- Types

- Grade A

- Grade B

- Grade C

- Economy office

|

- Serviced offices in District 1

- Serviced offices in District 2

- Serviced offices in District 3

- Serviced offices in District 4

- Serviced offices in District 7

- Serviced offices in District 10

- Serviced offices in Binh Thanh

- Serviced offices in Tan Binh

- Serviced offices in Phu Nhuan

- Serviced offices in District 12

Contact us for personalized office leasing advice

+84 988.902.468