Required Documents and Legal Procedures for Office Leasing

Leasing an office may seem straightforward, but it carries significant legal risks if businesses fail to prepare the required documents and fully understand the process. Having a clear grasp of the legal procedures not only protects your interests during contract signing but also helps prevent potential disputes throughout the lease term.

Table of Contents

- 1. Why Understanding Legal Documents and Procedures is Crucial in Office Leasing

- 2. Legal Documents Required Before Signing an Office Lease Agreement

- 3. Legal Process for a Compliant Office Lease

- 4. Key Legal Clauses in an Office Lease Agreement

- 5. Business Registration Procedures at a New Office Address

- 6. Legal Costs and Common Risks to Watch for When Leasing an Office

- 7. Frequently Asked Questions About Legal Procedures in Office Leasing

1. Why Understanding Legal Documents and Procedures is Crucial in Office Leasing

Leasing an office is not merely about choosing a suitable workspace – it is a legal process that requires accuracy, transparency, and strict compliance with regulations. Therefore, understanding the required legal documents and the proper leasing procedures helps businesses avoid unnecessary risks such as:

1.1 Avoid Legal Risks and Contractual Disputes

One of the most common mistakes is signing a lease agreement with a building that lacks essential legal documentation (such as construction permits, fire safety approvals, or property ownership certificates). This can lead to:

- The lease being deemed invalid due to the landlord’s lack of legal capacity

- Difficulties in registering the business at the leased address

- Risk of forced relocation or early contract termination without compensation

1.2 Ensure the Tenant’s Rights and Obligations are Legally Protected

An office lease agreement is a legally binding document that outlines the rights and obligations of both parties. Without carefully reviewing the terms or understanding the legal language, tenants may face:

- Unclear or unfair rent escalation clauses

- Unfavorable termination conditions

- Ambiguous liability for damages or risks

1.3 Legalize the Office Address for Business Registration

For newly established businesses or those changing their headquarters, the leased office address is used for business registration, tax filing, and opening a corporate bank account. If the lease is not legally valid or the office is not zoned for commercial use, it may result in:

- Rejection of the business license application

- Inability to claim input VAT, affecting legal compliance and financial reporting

1.4 Save Time and Costs in Administrative Procedures

When the lease documentation is complete and the process is clearly defined from the outset, businesses can save time in notarizing the lease, registering the business address, and avoid unnecessary administrative costs during the lease term.

2. Legal Documents Required Before Signing an Office Lease Agreement

2.1 From the Lessor (Building Owner or Developer)

Before executing the lease agreement, the lessor (building owner, developer, or authorized leasing agent) must provide complete and transparent documentation to verify the ownership and legal status of the office premises offered for lease.

The required documents include:

- Certificate of land use rights and ownership of attached assets (also known as the pink book or red book): proves the legal right to lease out the office premises.

- Construction permit: confirms that the building was legally constructed and designated for office use.

- Fire safety compliance certificate: mandatory for office buildings with five floors or more, or with large total floor areas.

- Business registration certificate (if the lessor is a company): verify that the registered business scope includes “real estate leasing” or “office leasing” services.

- Power of attorney (if signed on behalf of the owner): legal documentation is required to prove the signatory’s authorized representative status.

- Brokerage authorization documents (for leasing consultants): Maison Office or any broker must provide a cooperation agreement or official introduction letter from the building owner to ensure legal validity.

Note: Tenants should request to verify the original copies and/or notarized versions of the above documents, especially when leasing from a building they have not previously worked with.

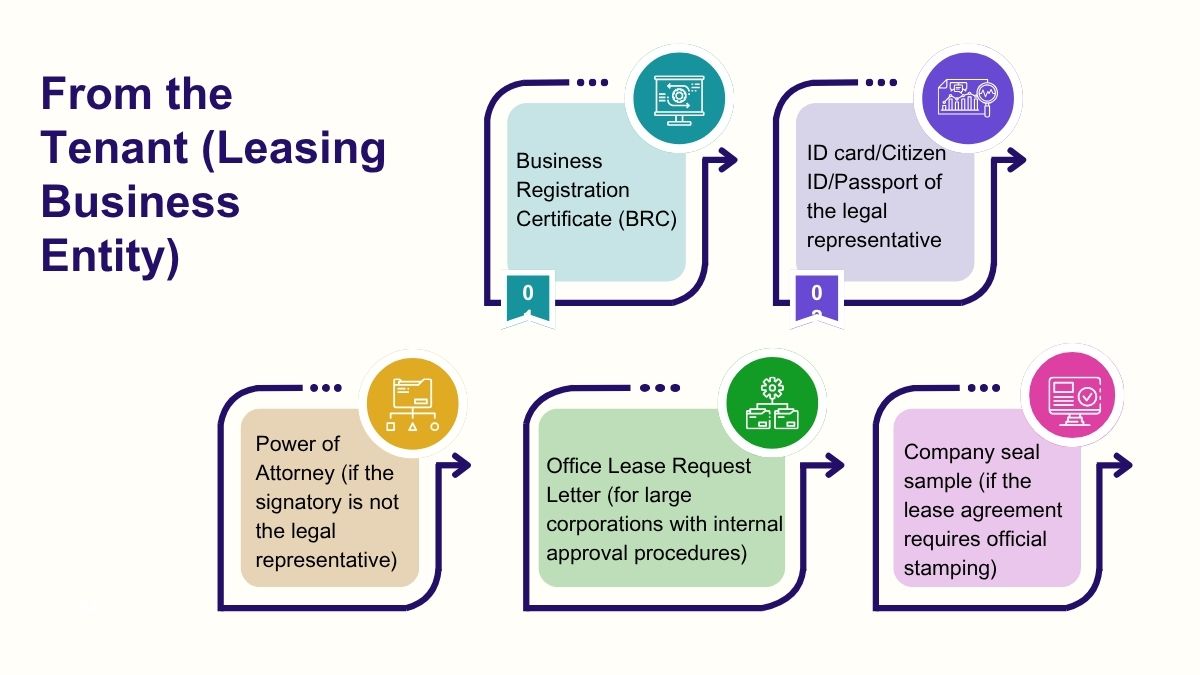

2.2 From the Tenant (Leasing Business Entity)

To ensure the lease signing process and office usage comply with legal regulations, the tenant must also prepare the following documents:

Documents required from the tenant (business entity):

- Business Registration Certificate (BRC): serves as legal proof of the company’s status and authority to enter into contracts.

- ID card/Citizen ID/Passport of the legal representative: required for verification at the time of signing.

- Power of Attorney (if the signatory is not the legal representative): must be accompanied by the ID of the authorized person.

- Office Lease Request Letter (for large corporations with internal approval procedures): applicable to enterprises with strict legal and accounting control policies.

- Company seal sample (if the lease agreement requires official stamping): used to finalize the lease contract and related payment procedures.

Note: If the business is in the process of incorporation, it is possible to lease an office space in advance and use the lease agreement to register the company’s headquarters address. However, it is crucial to ensure that the building is legally designated for office leasing to avoid rejection from the Department of Planning and Investment (DPI).

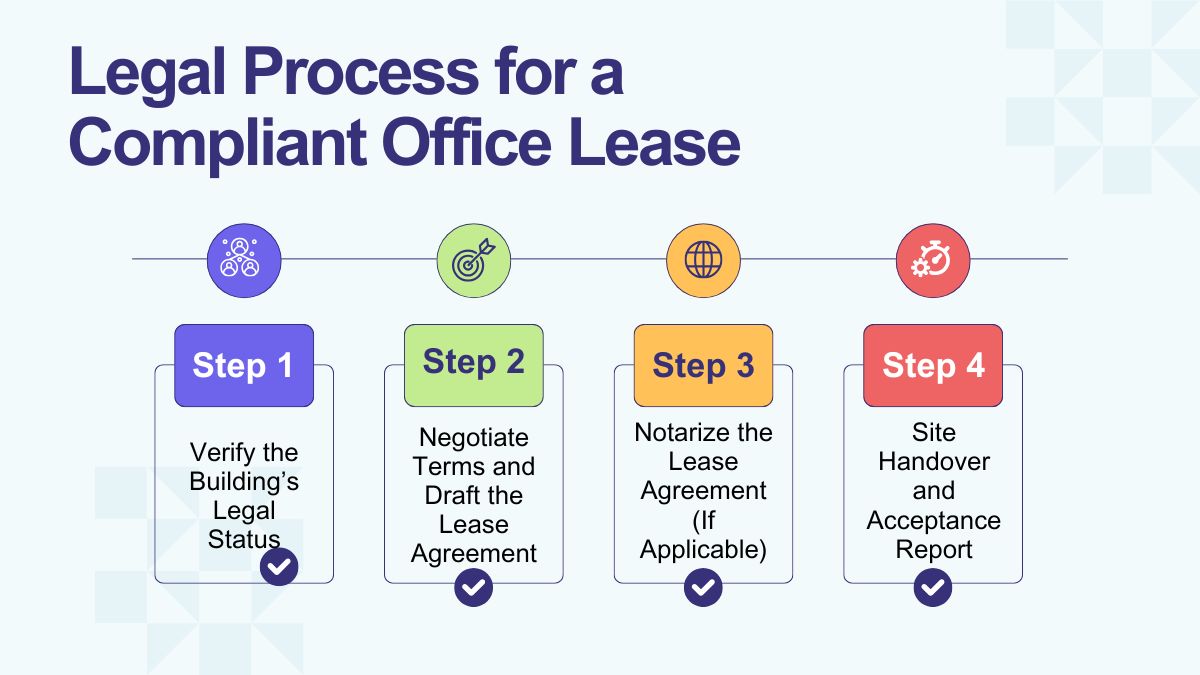

3. Legal Process for a Compliant Office Lease

To ensure that the office lease is lawful, secure, and facilitates smooth business operations, tenants must strictly follow the legal procedures. Below are four essential steps that every office tenant should fully understand:

Step 1: Verify the Building’s Legal Status

Before entering into rental negotiations, it is essential to verify the legal status of the office premises. This foundational step ensures that the lease agreement will be valid and not expose the business to unnecessary legal risks.

Key aspects to check:

- Does the building have a valid ownership certificate?

- Is there a construction permit authorizing the building’s use for commercial and office purposes?

- Has the building passed fire safety inspection and obtained official certification?

- Is the property legally approved for use as a registered business address?

Real case experience:Maison Office once advised a client to decline a lease agreement because the building lacked commercial use authorization – resulting in the client’s inability to register a business license at that address.

Step 2: Negotiate Terms and Draft the Lease Agreement

After verifying the building’s legal status, both parties proceed to negotiate key lease terms, including:

- Rental rate, lease term, and renewal conditions

- Hand-over area and current condition of the premises

- Service charges, VAT, and overtime fees (if applicable)

- Handover requirements upon lease expiration

- Rent-free fit-out period for office interior construction (if applicable)

The lease agreement should be documented in writing. For foreign tenants, a bilingual contract is highly recommended. The agreement should also include annexes with detailed floor plans for clarity and transparency.

Step 3: Notarize the Lease Agreement (If Applicable)

According to Article 492 of the 2015 Civil Code, lease agreements with a term of less than six months are not required to be notarized. However, many businesses still choose to notarize their contracts to strengthen legal validity – particularly in the following cases:

- Lease term of one year or more

- Using the lease agreement to register a business

- High contract value or potential legal disputes

Step 4: Site Handover and Acceptance Report

After the lease agreement is signed, the landlord will hand over the premises. The tenant should:

- Inspect the actual condition of the space: flooring, ceiling, electrical systems, air conditioning, fire safety systems, etc.

- Prepare a detailed handover report: documenting all components, their condition, and any attached fixtures or equipment (if applicable)

- Note the official handover date, which marks the beginning of the rental billing period

A properly documented acceptance report helps minimize future disputes when returning the premises at the end of the lease term.

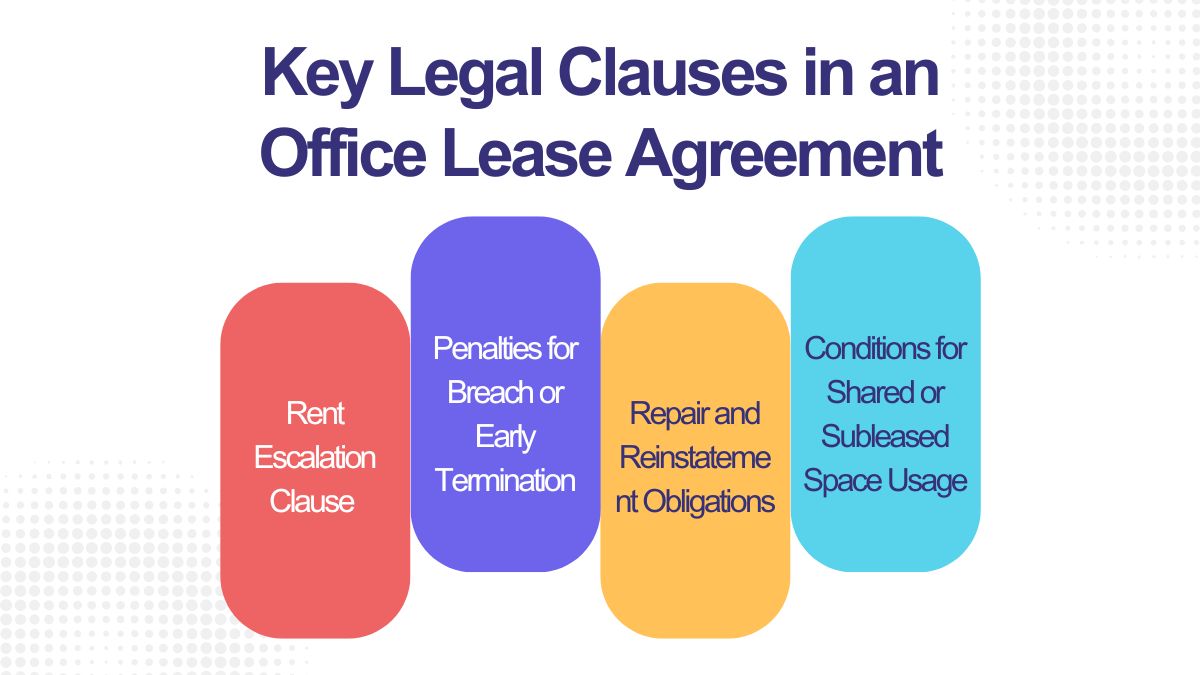

4. Key Legal Clauses in an Office Lease Agreement

An office lease agreement serves as the legal basis that defines the responsibilities and rights of both the tenant and the landlord. Understanding critical legal terms and procedures not only minimizes risk but also strengthens the tenant’s position during negotiations. Below are the most essential clauses to pay close attention to:

4.1 Rent Escalation Clause

Lease agreements often specify a fixed rental rate for an initial period, followed by scheduled adjustments based on:

- Consumer Price Index (CPI)

- USD/VND exchange rate fluctuations

- A fixed annual percentage (commonly 5 – 10% per year)

Note: Tenants should request that the agreement clearly defines the timing of rent increases, the maximum adjustment rate, and renegotiation rights in case of major market fluctuations.

4.2 Penalties for Breach or Early Termination

If either party terminates the lease before the agreed expiration date, the contract typically outlines:

- A specific penalty (commonly equivalent to 1 – 3 months’ rent)

- Deductions for incurred costs: fit-out, reinstatement, brokerage commissions (if applicable)

- Advance notice period: usually 30 – 60 days

Maison Office’s advisory contracts include carefully negotiated clauses to ensure tenants are not unfairly bound in case of strategic changes or expansion needs.

4.3 Repair and Reinstatement Obligations

This clause is often overlooked but can lead to major disputes at the end of the lease term. It should clearly define:

- Which party is responsible for interior fit-out and repairs to electrical, plumbing, ceiling, and flooring systems

- Whether the tenant is obligated to reinstate the space to its original condition

- What level of wear and tear is considered acceptable

Tip: It is recommended to attach a premises handover annex with photos documenting the original condition as a reference for reinstatement.

For businesses planning to share office space (e.g., startups, support teams), it is crucial to clarify:

- Is subleasing a portion of the space permitted?

- Can seats be shared with partner companies?

- Are common areas accessible: reception, pantry, meeting rooms, restrooms?

Many landlords strictly prohibit shared usage without prior written approval – this must be explicitly stated in the lease agreement or in an attached memorandum.

5. Business Registration Procedures at a New Office Address

5.1 Conditions for Using the Office Address as Company Headquarters

Before registering a business at a leased office address, the following conditions must be met:

- The building must be legally designated for commercial/office use — not a residential apartment or condominium.

- The lease agreement must be valid, signed, and stamped by the building owner or authorized lessor.

- The address must not be associated with a suspended tax ID or registered by another business illegally.

Recommendation: Lease office space in buildings verified and advised by Maison Office — where legal documents have been thoroughly reviewed and business registration support is readily available.

5.2 Documents Required for Business Registration

- Business registration application (as per the standard form of the Department of Planning and Investment)

- Company charter

- List of members/shareholders

- Copies of IDs/Passports of members

- Office lease agreement (including annexes and handover minutes, if applicable)

- Legal documents of the building (if requested by the authority)

5.3 Submission Channels and Processing Time

- Submission location: Business Registration Office – Department of Planning and Investment of the province/city where the office is located

- Submission method: Online via the National Business Registration Portal or by direct submission

- Processing time: 3 – 5 working days

5.4 Post-Registration Reminders

- Update the new address with the Tax Department, bank, and Social Insurance Agency

- Install a company signboard at the office to avoid administrative penalties during inspections

- Submit bank account registration documents and activate electronic tax filing immediately after obtaining the new Business Registration Certificate

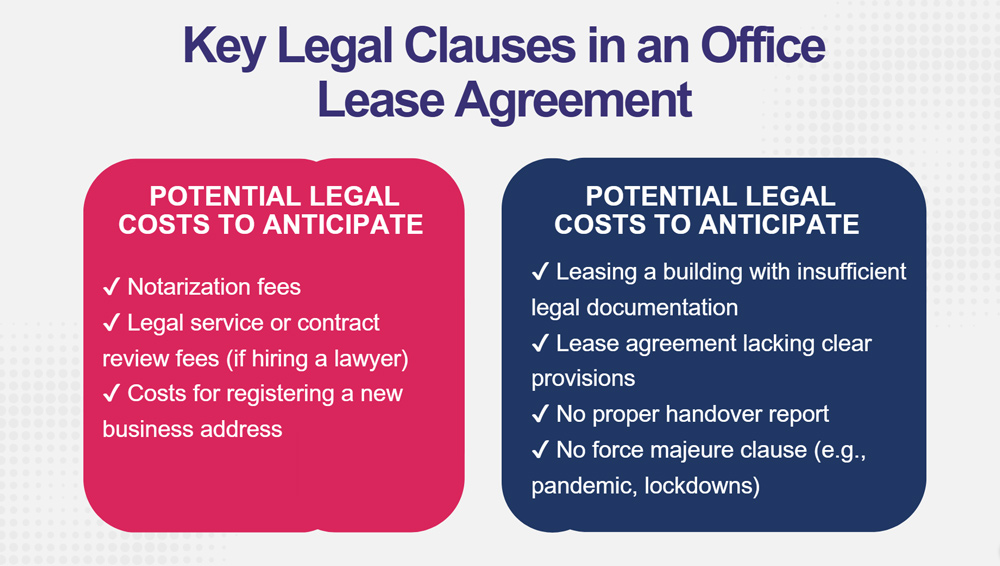

6. Legal Costs and Common Risks to Watch for When Leasing an Office

When leasing office space, businesses should be aware that, beyond rental fees, there may be unexpected legal costs and contractual risks – especially if the leasing process and terms are not clearly understood. Below are key factors to consider:

6.1 Potential Legal Costs to Anticipate

Notarization fees

While not mandatory for lease agreements under six months, many businesses still opt for notarization to strengthen legal validity.

- Notarization fees typically range from 0.1% to 0.5% of the contract value, with a maximum cost of several million VND (approx. USD $50–200).

Legal service or contract review fees (if hiring a lawyer)

For high-value leases or tenants that are foreign direct investment (FDI) entities, it is advisable to engage a lawyer to review and negotiate the lease terms.

- Legal fees range from VND 5–15 million per case (~USD $200–600), depending on complexity.

Costs for registering a new business address

Includes government fees for business registration, company stamp engraving, and signboard installation.

- Total cost typically falls between VND 1–3 million (~USD $40–120), excluding service fees if using a third-party agency.

6.2 Common Legal Risks in Office Leasing

Leasing a building with insufficient legal documentation

Lack of construction permits, fire safety certificates, or incorrect building function (not designated for office use) may result in:

- Inability to register the business at the address

- Rejection of the business license application by the Department of Planning and Investment

Lease agreement lacking clear provisions

- No specific clauses regarding additional fees, renewal terms, or early termination conditions → increases risk of disputes

No proper handover report

- Absence of photos or detailed descriptions of the premises at handover → tenant may be unfairly held responsible for damages upon returning the space

No force majeure clause (e.g., pandemic, lockdowns)

- May lead to financial loss without any rent reduction or waiver despite unforeseen disruptions

7. Frequently Asked Questions About Legal Procedures in Office Leasing

7.1 Is notarization required for office lease agreements?

Notarization may be required if the lease term is six months or longer and either party requests it. In many cases, notarization enhances legal validity and helps prevent disputes.

7.2 Is a lease contract required for virtual offices?

Yes. Whether leasing a virtual or physical office, a valid lease agreement is still required to establish a company’s legal business address for registration purposes.

7.3 Can a leased office be used as a company’s registered address?

Yes, provided the building is legally designated for office use under zoning regulations. It is important to verify the construction permit and land use function before signing the lease.