How to Negotiate an Office Lease – Key Tips for a Better Deal

Negotiating office leases is a crucial process to ensure your business not only secures an ideal workspace but also optimizes cost savings. Leasing office space is not simply about choosing a physical location; it’s also about establishing a long-term relationship and strategy for your company’s growth.

This guide has been developed by Maison Office based on over 10 years of experience in advising and supporting clients in leasing office spaces. Let’s explore the detailed information below to make the leasing process smooth and maximize value for your business!

10 Essential Office Lease Negotiation Tips You Should Know:

- Total Cost is a Key Factor to Consider

- Understand the Method for Measuring Leased Space

- Identify Non-Functional Areas

- Negotiate Rent Adjustment Clauses in the Lease Term

- Pay Attention to Exchange Rates in Payment Terms

- Compare Costs for Interior Build-Outs

- Service Fees During Interior Build-Out Period

- Security Deposit and Reservation Procedures

- Solutions When Rent Reductions Are Not Possible

- Seek Support from a Real Estate Broker for Negotiation Assistance

|

|

Table of Contents

- 1. Total Costs are a Key Factor to Consider

- 2. Understand the Method for Measuring Leased Space

- 3. Identify Non-Functional Areas

- 4. Negotiate Rent Adjustment Clauses During the Lease Term

- 5. Pay Attention to Exchange Rates in Payment Terms

- 6. Compare Costs for Interior Fit-Outs

- 7. Service Fees During Interior Build-Out Period

- 8. Reservation and Deposit Process

- 9. Solutions When Rent Reductions Aren’t Possible

- 10. Seek Negotiation Support from a Real Estate Broker

1. Total Costs are a Key Factor to Consider

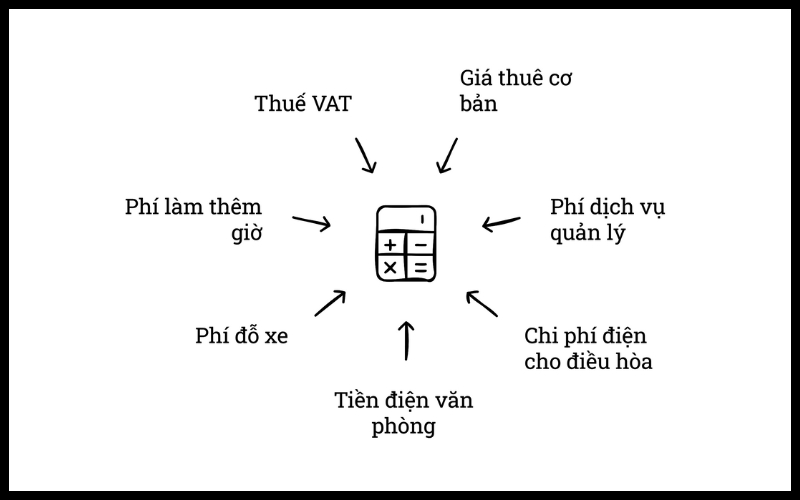

When searching for and negotiating an office lease, the most important factor to focus on is the total cost, not just the base rent. Rent is only one part of the cost equation, and therefore, understanding and comparing all related expenses will give you a clearer picture of the total amount you need to pay.

Here are some basic costs to consider:

- Base rent

- Building management service fees

- Air conditioning electricity costs

- Electricity consumption within the office

- Parking fees for cars and motorcycles

- Overtime work charges (if you often work outside business hours)

- VAT (Value Added Tax)

Having an overview of these costs will help you make an informed decision, avoiding unexpected expenses once the lease is signed. Be sure to have full information and request transparency from the landlord or leasing company to avoid any unwelcome surprises.

2. Understand the Method for Measuring Leased Space

To negotiate effectively on rent, it’s crucial to understand the method the landlord uses to calculate the leased area. Office buildings in categories A, B, and C often use different methods, which directly impact rental costs.

There are three common methods:

- Net Usable Area – the actual usable area inside the office space.

- Built-Up Area – includes the walls and partitions surrounding the office.

- Centerline Area – measures from the center of the walls surrounding the office.

Typically, the net usable area is about 3-5% smaller than the built-up area, as it does not include the walls. Understanding how your leased area is measured helps you compare rent prices accurately across different buildings and avoid unclear charges in your lease agreement.

3. Identify Non-Functional Areas

When leasing office space, it’s important to assess the truly usable area and identify areas that are non-functional. These are spaces like awkward corners, areas that cannot be used efficiently, or offices with irregular shapes, such as sharp angles or complicated layouts. Offices with numerous columns or beams can also reduce effective usable space, affecting comfort and optimizing workspace.

Make sure to identify these areas during your property tour and use them as a negotiation point to adjust the rent, ensuring you only pay for the space that provides real value.

4. Negotiate Rent Adjustment Clauses During the Lease Term

Many landlords include clauses in the lease agreement to adjust the rent periodically, either annually or every two years. While these clauses are meant to ensure fairness—by adjusting rents according to market conditions—they don’t always benefit the tenant.

Once you’ve invested in interior renovation and office setup, tenants are often at a disadvantage in negotiations for rent adjustments. This clause is something to pay close attention to and negotiate for reasonable increases or even limit rent hikes throughout the lease term. This will help you control costs and avoid unwanted financial fluctuations.

5. Pay Attention to Exchange Rates in Payment Terms

In many office lease agreements, payments are often converted from USD to VND. It’s important to clarify which exchange rate applies. Be sure to know whether the rate will be based on the buy rate, sell rate, or the average rate, and ask for clarification to avoid confusion during payment.

According to regulations from the State Bank of Vietnam, landlords are required to convert rent and service fees from USD to VND when signing the lease. Some buildings adjust rent according to fluctuations in the USD/VND exchange rate, while others may keep the rate fixed. Over the last 10 years, the average USD/VND exchange rate has increased by about 4% per year. Knowing this clause helps you control costs and avoid financial risks due to exchange rate fluctuations.

6. Compare Costs for Interior Fit-Outs

Each office handover may come with different standards for ceilings, flooring, partitions, and doors, so interior fit-out costs will vary depending on the level of renovation needed. This directly affects the initial investment and should be carefully considered during negotiations.

To optimize costs, get quotes from multiple reputable interior design contractors. Knowing these prices not only helps you budget but also supports negotiations with the landlord to secure favorable conditions or discounts. Choosing the right contractor will help you maximize your workspace and save on costs.

7. Service Fees During Interior Build-Out Period

During the interior build-out phase, many buildings may offer free rent for 15 to 30 days to give tenants time to prepare their office space. However, service fees such as security, cleaning, and maintenance may still apply during this period.

Some buildings may have promotional policies where they only charge electricity based on actual consumption, measured by meters, reducing additional costs for tenants. Be sure to clarify these service charges during negotiations to optimize your budget and avoid unexpected costs during the fit-out period.

8. Reservation and Deposit Process

Leasing negotiations typically involve two main steps: (i) signing the offer to lease and paying a reservation deposit equal to one month’s rent, and (ii) signing the official lease contract and paying an additional deposit, usually equal to two months’ rent.

Note that the offer to lease often doesn’t list all the fees the tenant is responsible for. Therefore, request a draft of the lease agreement from the landlord to get a clearer view of the specific costs. This helps you negotiate better and avoid hidden charges.

9. Solutions When Rent Reductions Aren’t Possible

In many cases, buildings will maintain fixed rent rates to ensure consistency with other tenants. If you’re unable to negotiate a rent reduction, you can still be flexible by negotiating other favorable terms.

Suggestions include:

- Rent-free periods for the first few months

- Waiving or reducing parking fees

- Extending working hours without additional overtime charges

These benefits can help you save significant costs even if the rent price cannot be reduced.

10. Seek Negotiation Support from a Real Estate Broker

To negotiate effectively when leasing office space, it’s advisable to ask the broker for detailed information about the market and the building. Useful information includes:

- Pros and cons of the building and its current occupancy rate

- Availability of the office space you’re interested in (whether there are multiple options)

- History of previous tenants, including reasons for moving out (if applicable)

- Rent rates for other tenants in the same building

- A comparison of rental prices and service fees for buildings in the same area

This information will give you a clear understanding of the market situation and provide leverage in negotiations. A reputable broker with access to extensive data can help you make informed decisions, save costs, and optimize your office choice.

Currently, Maison Office maintains an up-to-date database of available office spaces and offers helpful documents like “Office Proposals” and “Cost Comparison Reports.” These resources will ensure that you have all the market information you need to make the best decision.

Contact Maison Office for Free, Quick Consultation and Support in Leasing Office Space, or to Explore Office Spaces for Rent in Hanoi or Ho Chi Minh City.

See more:

- Office Space Lease Agreement Template in VietNam

- Time to issue office rental invoices in Viet Nam [Latest regulations]

- How to Account for Office Rent Expenses [New Regulations]

- Office rental tax rate 8 or 10? Can VAT be reduced?

Editor and content team manager at Maison Office.

With over 5 years of experience in consulting and extensive content editing in the real estate services and interior design field. Sharing valuable information with customers, partners, and attracting millions of views.