Hanoi Office Leasing Market Outlook 2026

Entering 2026, the Hanoi office leasing market is moving into a phase of stability accompanied by heightened competition, as new supply continues to enter the market and corporate tenants adopt a more cautious approach to leasing decisions. Rental rates are expected to edge up slightly, while market leverage is likely to remain in favor of tenants. The growing focus on workspace quality, cost optimization, and operational efficiency is shaping office leasing strategies in Hanoi in the coming period.

See more: HCMC Office Leasing Market Outlook 2026

|

|

Table of Contents

1. Overview of the Hanoi Office Market in 2025

In 2025, the Hanoi office market continued to maintain a stable performance, with rental rates showing limited fluctuation and occupancy levels gradually improving compared to the previous period. Total office supply reached approximately 2.3 million square meters across nearly 190 office buildings, with the inner-city areas and western districts accounting for the largest share. This clearly reflects the ongoing shift of office development beyond the traditional CBD.

Leasing activity throughout the year was primarily driven by office relocations and upgrades, as companies sought to balance cost optimization with improvements in workplace quality. Key demand continued to come from sectors such as finance, insurance, real estate, information technology, and manufacturing. The introduction of several new office projects-well-invested in terms of design, amenities, and operational standards-has laid an important foundation for the market to transition into a more competitive phase in 2026.

2. Potential for Growth in the Hanoi Office Market

Entering 2026, the Hanoi office market is expected to maintain a positive growth outlook, despite increasing competitive pressure from new supply. Market momentum is being driven mainly by corporate demand for relocation, upgrading, and office restructuring, rather than pure expansion in leased area as seen during previous high-growth cycles.

The growth potential of the market in 2026 is closely linked to the increasingly pronounced decentralization trend. Areas such as Ba Dinh, Cau Giay, Tay Ho Tay, and the western districts of Hanoi continue to attract strong interest, supported by improved transport infrastructure, ample development land, and the emergence of high-quality office projects. This trend provides businesses with a wider range of location options while enabling access to modern workspaces at more competitive costs compared to the traditional CBD.

Beyond location, building quality and user experience are playing an increasingly important role in leasing decisions. Projects that emphasize flexible design, green standards, comprehensive on-site amenities, and operational efficiency continue to record stable demand, particularly from companies in the technology, finance, consulting, and professional services sectors. In this context, the Hanoi office market in 2026 is being shaped toward a stable, selective, and value-driven competitive environment, laying a solid foundation for sustainable growth in the years ahead.

3. Forecast for Hanoi Office Market in 2026

Entering 2026, the Hanoi office market is expected to remain stable but highly competitive, as new supply continues to come on stream and tenant demand becomes more cautious and selective. Office leasing decisions are no longer driven primarily by central locations, but increasingly by workspace quality, cost-efficiency, and long-term operational effectiveness.

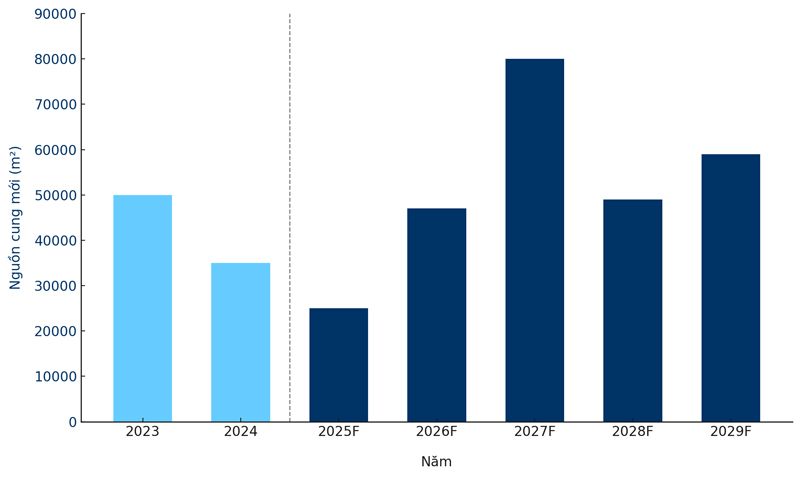

3.1 New Supply Trends

Office supply in Hanoi in 2026 will mainly be delivered by projects that were completed or under development during the 2024–2025 period, with a strong concentration in the Grade A and B+ segments. Rather than being clustered in the traditional CBD, new developments are expanding into areas such as Ba Dinh, Cau Giay, Tay Ho Tay, and the western districts of Hanoi, clearly reflecting the market’s ongoing decentralization trend.

Notably, new office developments are no longer concentrated solely in the traditional core CBD, but are increasingly expanding into areas with clear administrative and office-oriented development plans such as Ba Dinh, Tay Ho Tay, Cau Giay, and the western districts of Hanoi.

These new buildings are being developed with a strong focus on high-quality design, flexible floor plates, green building standards, and modern building management systems, in order to meet the increasingly sophisticated requirements of corporate tenants. In this context, new supply plays a dual role: elevating the overall quality benchmark of the market while simultaneously intensifying competition, compelling existing buildings to enhance services and leasing policies to remain competitive.

3.2 Tenant Demand & Preferences

In 2026, the Hanoi office market is expected to continue recording steady growth in leasing demand, primarily driven by key economic sectors such as banking, information technology and telecommunications (IT), insurance, manufacturing, and logistics. Forecasts indicate that the IT sector will lead demand, accounting for approximately 24% of total transacted area, followed closely by the finance, banking, and insurance (FBI) sector at over 20%.

Both sectors are actively driving demand for expansion and relocation into modern office spaces that can support their evolving business requirements and long-term growth strategies.

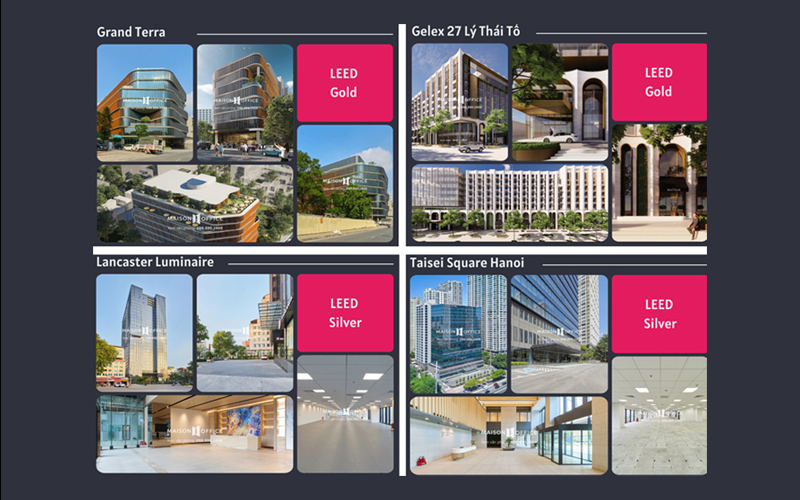

The office leasing trend in Hanoi is shifting strongly toward Grade A office buildings, with a clear preference for workspaces that meet international standards such as green certifications, environmental sustainability, and energy efficiency. Green office buildings not only support corporate sustainability goals but also provide modern working environments aligned with the expectations of a young, dynamic, and creative workforce – an increasingly dominant segment within Hanoi’s labor structure.

At the same time, large enterprises are showing a growing tendency to expand their office footprint while applying higher standards in workspace design, building amenities, and operational flexibility. This shift aims to accommodate new working models, enhance corporate branding, and improve overall operational efficiency. Flexible workspaces supported by innovative design solutions are becoming a top priority, enabling organizations to strengthen corporate culture and attract and retain talent more effectively.

3.3 Rental Prices & Competition Levels

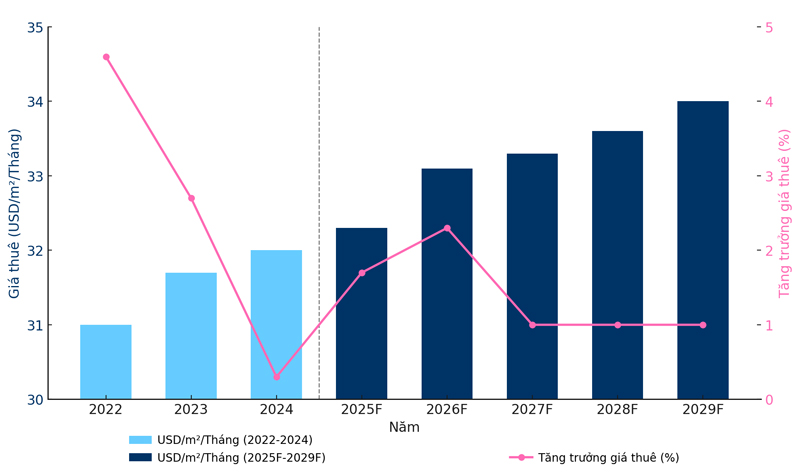

Entering 2026, office rental rates in Hanoi are forecast to continue a slow and stable upward trend, clearly reflecting the market’s rebalancing phase following the recovery period of 2023–2025. Market data indicates that after reaching a growth trough in 2024, rental levels recorded a modest recovery in 2025 and are expected to increase at a low growth rate from 2026 onward, suggesting limited short-term upside in rental escalation.

Grade A and B+ office buildings with prime locations, high construction quality, and professional management are expected to maintain more stable rental levels compared to the broader market, while less competitive or aging properties are likely to face downward pressure on pricing and leasing terms.

In this context, competition among landlords is becoming increasingly pronounced. Rather than competing directly on headline rental rates, the market is seeing a growing emphasis on commercial incentives such as rent-free periods, fit-out cost support, and greater flexibility in lease terms and contract structures. At the same time, competition has shifted decisively toward non-price factors, including service quality, on-site amenities, building management technology, and overall occupier experience. These elements have become key differentiators enabling office buildings to sustain healthy occupancy levels and long-term asset value in Hanoi’s office market in 2026.

3.4 Technology & Future Office Models

Technological advancement is reshaping Hanoi’s office leasing market through the emergence of smarter and more flexible workplace models. Businesses are increasingly prioritizing offices integrated with advanced technologies such as IoT systems, data analytics, and smart sensors to enhance operational efficiency, space management, and overall user experience.

In parallel, hybrid office models—combining on-site and remote working—are becoming a prominent trend. This approach not only helps reduce operating costs but also aligns with corporate objectives to improve productivity and support work–life balance. Future office buildings are therefore required to continuously innovate their workplace design to meet the expectations of a younger, dynamic workforce, particularly within fast-growing sectors such as technology and finance.

Overall, Hanoi’s office leasing market in 2026 is expected to remain stable yet highly competitive, characterized by slow rental growth and a wide range of options for tenants. Occupiers are placing greater emphasis on workspace quality, building management services, and cost efficiency, while landlords must adopt more flexible leasing strategies to maintain market appeal. Selecting the right office segment and leasing strategy will be a critical factor in achieving long-term operational efficiency and sustainability.

Looking for the perfect office space in Hanoi? Explore Maison Office premium leasing options today! Discover Office for Lease in Hanoi

Editor and content team manager at Maison Office.

With over 5 years of experience in consulting and extensive content editing in the real estate services and interior design field. Sharing valuable information with customers, partners, and attracting millions of views.