The picture of HCMC Office Market in 2024

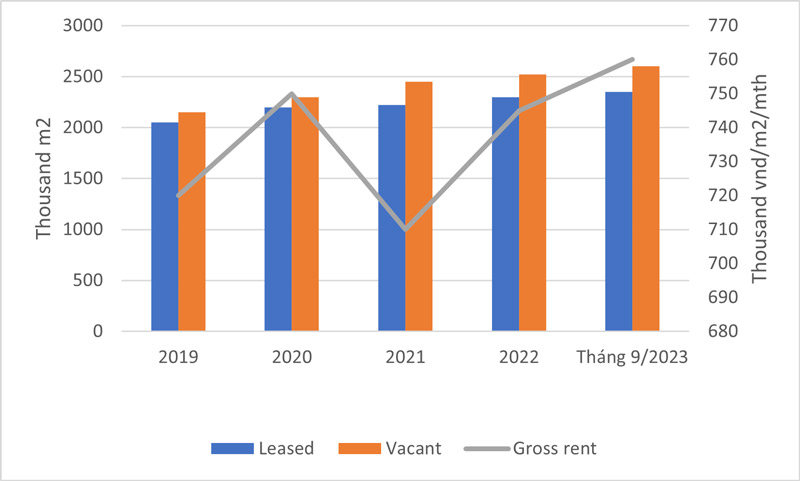

At the beginning of 2024, the office market in Vietnam became vibrant with a new supply. Over 135,000 m2 of leasing area in Hanoi and nearly 160,000 m2 in Ho Chi Minh City, especially Grade A office projects in centre locations. 2024, it will continue to be a year of explosive supply in the Ho Chi Minh City office leasing market.

Table of Contents

1. Explosion of new office for lease

Ho Chi Minh City has a rapid increase in supply with more than 135,000 sqm of new office leasing space completed in Hanoi and over 160,000 sqm in HCMC. Notably, the majority of this area belongs to Grade A office projects in center locations.

Outstanding office projects that have come into operation include The Nexus and VPBank Saigon Tower in District 1, as well as The Mett and The Hallmark in Thu Thiem area, expected to become the new CBD of the city. The steady growth, especially with a 68% jump in Grade A office spaces in 2023, shows the market is developing well.

The explosion in new supply is driven by several factors, including:

– Vietnam’s economy maintaining a high growth rate, attracting numerous foreign investors.

– The increasing demand for high-quality office spaces from multinational corporations and startups.

– Government incentives policies to attract investments into the real estate sector.

Ho Chi Minh City office market in 2024 grows phase with new supply expected to reach approximately 53,000 m2, mainly focused on the suburban areas. At the same time, it also committed to environmental protection.

2. New office buildings in 2024 – 2026

In 2024, the market has many new office projects, especially in the Grade A and B segments. Below are some of the new office buildings expected to be completed and operational during the 2024 – 2026 period.

2.1. Vinatex Building

Vinatex Building is developed by Viet Nam Industrial Infrastructure Development & Textile Trading Manufacturing Corporation – Vinatex ITC, covering a total construction area of about 11,000 sqm.

Known as a Grade A office for lease and apartment complex, Vinatex Building offers modern, convenient spaces at reasonable costs for businesses looking to establish a headquarters or representative office in the central area of Ho Chi Minh City.

2.2 Daikin Tower

Daikin Tower is a grade A office for lease located at the prime address of 10 Cong Truong Me Linh, Ward 6, District 3.

The project is developed by Phucdat Production And Trade Co.Ltd, featuring 13 floors and 3 basements. Daikin Tower boasts a modern, luxurious design with a tempered glass facade offering expansive views. The building is expected to be an ideal choice for businesses looking for a headquarters or office space in a prime location, with a convenient and professional working environment.

2.3 Victory Tower

Victory Tower is a Grade B+ office building located in Go Vap District – a rapidly developing area in Ho Chi Minh City. Although not situated in the city center, the building still draws significant interest from businesses due to its convenient transportation access and reasonable office rental prices.

The development of the region also creates growth potential for businesses establishing their presence here. Victory Tower is expected to become operational in the first quarter of 2024.

2.4 The Sun Tower

Developed by Capitaland, a leading real estate developer in Asia, the project promises to offer a top-notch and convenient workspace for leading businesses. The Sun Tower is a premium project located at a luxurious spot within the Grand Marina Saigon complex in District 1, HCM City.

2.5 LP Bank Tower

LP Bank Tower is a modern office building located on Nguyen Thi Minh Khai Street, District 1, Ho Chi Minh City. The project is invested by Far East Pearl Real Estates Investment Joint Stock Company and designed by talented architects, providing a professional and prestigious workspace for businesses.

2.6 ETown 6

ETown 6 is the latest office building in ETOWN Tan Binh, close to the airport and major industrial zones. The building is designed to high standards, fully meeting safety, comfort, and a pleasant working environment criteria. This will attract businesses operating in the industrial sector and services related to the airport.

2.7 V Plaza Towers

V Plaza Towers is a Grade A twin tower located in Saigon South Residences, on Nguyen Van Linh Boulevard, Tan Phong Ward, District 7. The project is a joint venture between Saigon Co.op and Mapletree (Singapore), with a total floor area of over 66,000 sqm.

2.8 TD Tower

TD Tower is located on Hanoi Highway, Thao Dien Ward, Thu Duc City. The project has a total floor area of 10,747 m2, featuring a 17-story and 3 basement levels. TD Tower is invested by Duy Trung Y Investment Joint Stock Company and constructed by Sol E&C Investment Construction Joint Stock Company.

2.9 Saigon Luxury

Saigon Luxury is located at 11D Thi Sach, Ben Nghe Ward, District 1, Ho Chi Minh City, stands out with its modern architectural design that gracefully integrates the softness of East Asian culture.

Invested by Saigon Apartments Company Limited, the project features 3 basements – 22 floors, and a total area of 28,194 sqm. Saigon Luxury promises to become a new landmark in the heart of Ho Chi Minh City.

2.10 A&T Building

A&T Building is invested by An Khang Business Company Limited, consisting of 3 basements, 14 upper-floors & a rooftop. A&T Building is considered one of the ideal choices for businesses seeking a modern, high-class office to establish their brand’s status.

These new office buildings not only meet the demand for workspace but also reflect the upgrade and progress in the office for lease in HCMC.

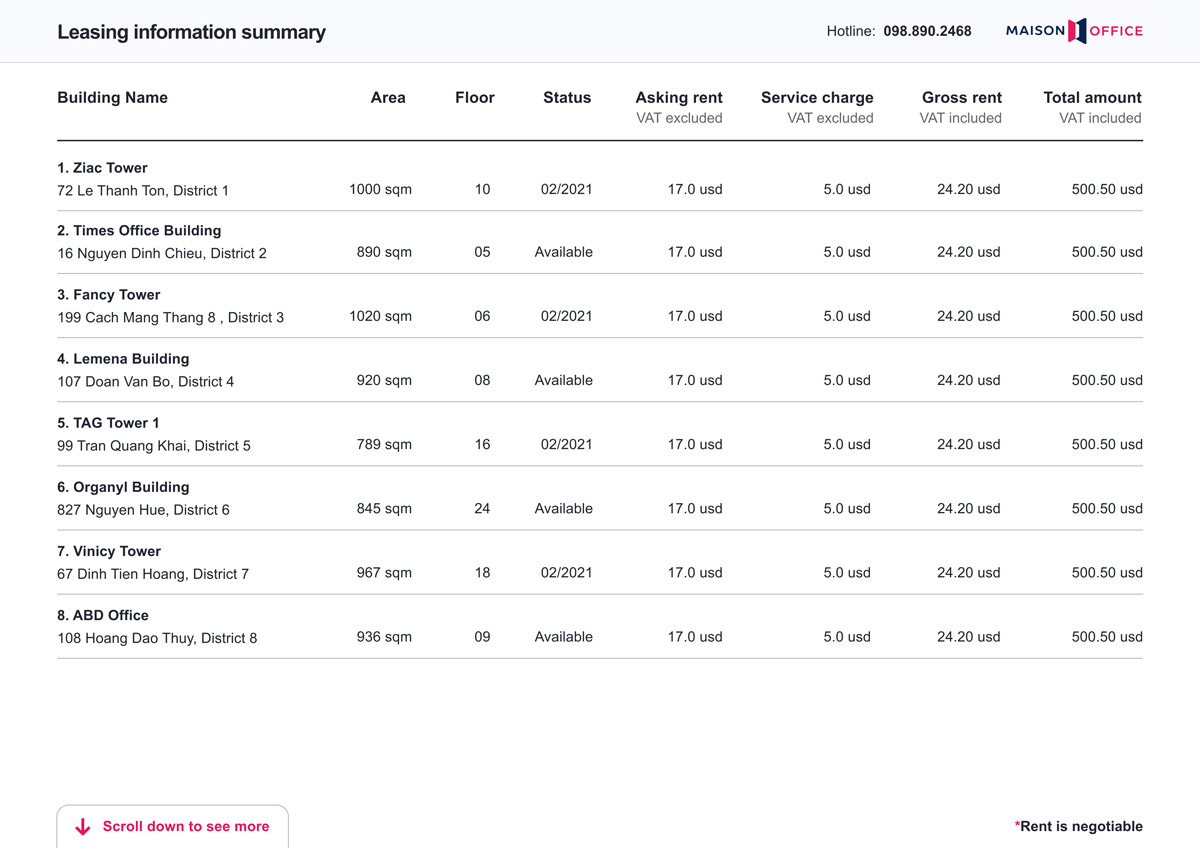

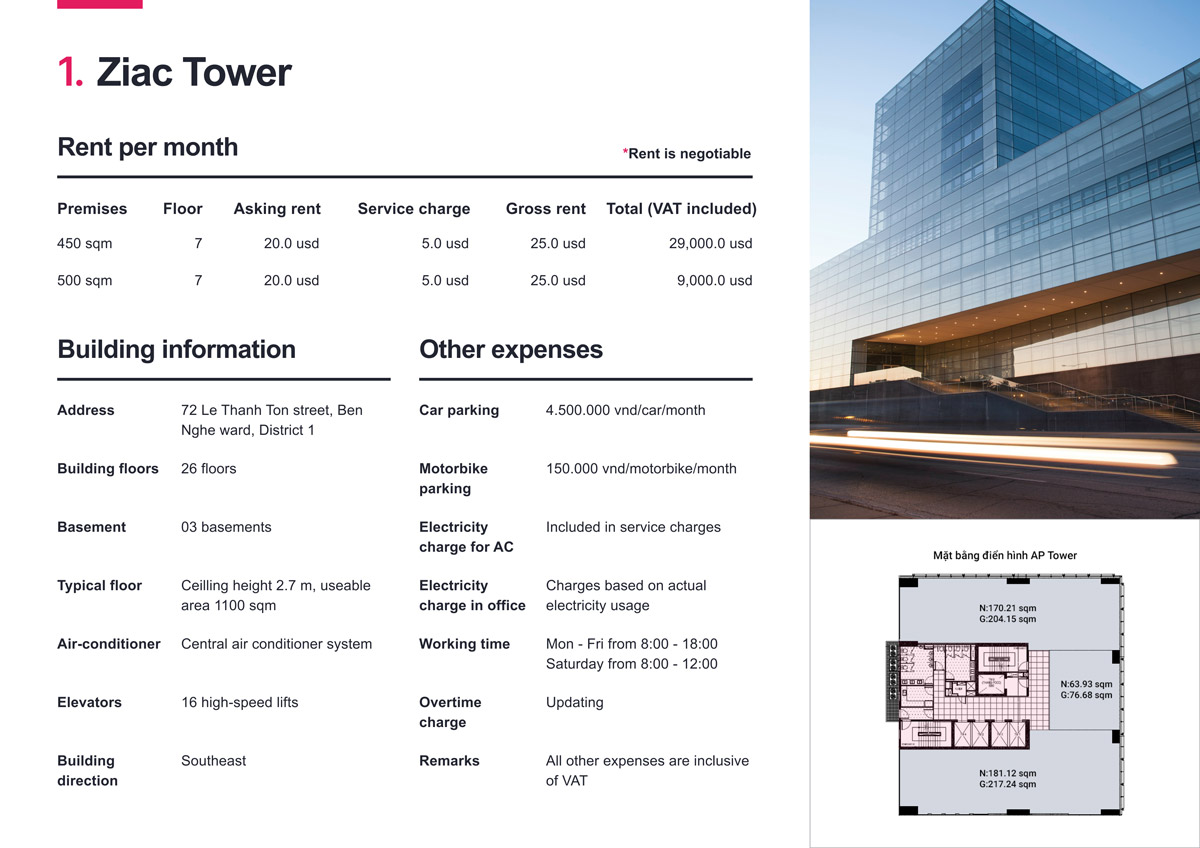

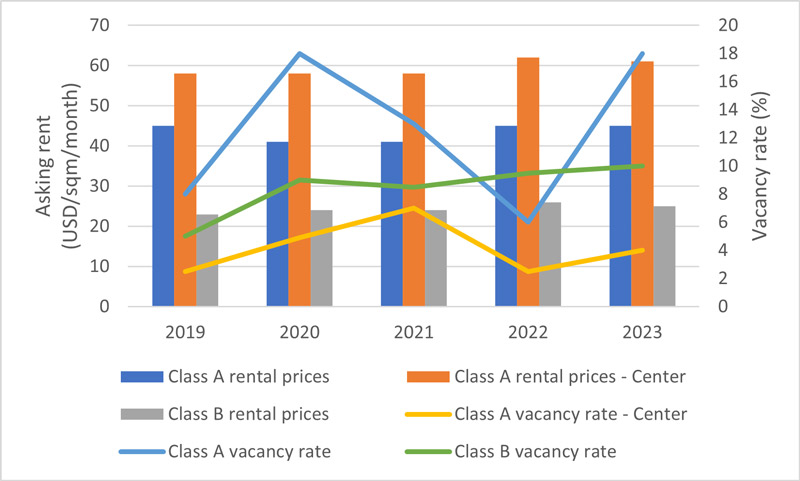

3. Rental prices remain stable

Despite the simultaneous entry of many new projects into Ho Chi Minh City office market, rental prices have remained stable, especially for Grade A and Grade B offices.

With Grade A office rents at from 45 USD/sqm/month and Grade B at from 25 USD/sqm/month, the market maintains price stability, providing favorable conditions for businesses and tenants.

The primary reason for this stability is not just the influx of new projects but also the significant negotiating power of tenants. Even amidst market pressure from a large new supply, tenants have been able to negotiate effectively and maintain rental price stability.

So, these conditions offers stable rental prices while still providing access to high-quality projects.

4. Slight increase in vacancy offices

The occupancy rate for office spaces in the second half of 2023 remained strong, with nearly 80,000 sqm of office for lease, primarily from new Grade A buildings. Specifically, the vacancy rates for Grade A and B projects in HCMC have seen a slight increase but nothing significant.

2024, the vacancy rates are 18.6% for Grade A and 10.1% for Grade B, an increase of 12.5% points and 1.4% points, respectively, compared to the same period last year. Despite this increase, the rates remain relatively low, demonstrating HCMC’s determination to maintain a balance between the supply of office spaces and rental demand.

5. HCMC Office Market for 2024 – 2026

The HCMC office rental market is expected to remain vibrant with many businesses moving to new offices to improve work quality and find reasonable rental rates, accounting for about 48% of transactions in HCMC.

In 2024, new office supply of about 53,000 sqm will be mainly located in suburban areas. Due to limited central land and high rental prices, many companies are opting to move to suburbs like Thu Duc, District 2, District 9, and Tan Binh.

Currently, the Hybrid office leasing model is becoming a popular trend chosen by many businesses due to its flexibility and utility, meeting diverse employee work needs and fitting various business models.

Additionally, there is a trend of large corporations moving their offices to Vietnam, especially HCMC, which is expected to continue rising between 2024-2026. This will provide a significant supply to the HCMC office rental market.

To meet the office leasing demand, by 2026, about 70% of office supply is expected to come from Grade A and B projects, and these projects achieve sustainability certifications such as Green Mark and LEED. This indicates a growing interest in sustainability standards in the office sector. For businesses, choosing to lease office spaces with sustainability certifications can be a crucial factor in decision-making, also reflecting a commitment to social and environmental responsibility.

2024 – 2026, office rental prices in the HCMC office leasing market are expected to slightly decrease. However, the office market will remain strong and stable due to the occupancy of a large office supply.

Companies within the Finance, IT, and Distribution fields are anticipated to pursue further growth, significantly influencing office space demand and contributing to the sustained equilibrium of the market.

The office market in HCMC is experiencing significant growth not just in terms of space but also in the quality of office buildings. This meets the diverse needs of businesses and offers positive outlooks for both landlords and tenants in the HCMC office.

Editor and content team manager at Maison Office.

With over 5 years of experience in consulting and extensive content editing in the real estate services and interior design field. Sharing valuable information with customers, partners, and attracting millions of views.