Time to issue office rental invoices in Viet Nam [Latest regulations]

![Time to issue office rental invoices in Viet Nam [Latest regulations]](https://maisonoffice.vn/en/wp-content/uploads/2024/04/time-of-issuing-office-rental-invoices.jpg)

Individuals and organizations providing office rental services need to understand the form of invoices but also must pay attention to the time of issuing office rental invoices. This ensures office rental business activities comply with tax and invoice laws. In this article, let’s learn about specific regulations on when to issue rental invoices as well as how to write standard office rental invoices!

|

|

Table of Contents

- 1. Types of invoices that need to be issued when renting an office

- 2. When is the office rental invoice issued?

- 3. Penalty regulations when issuing invoices at the wrong time

- 4. Characteristics of an invoice

- 5. Instructions on how to write office rental invoices

- 6. A few important notes when issuing office rental invoices

1. Types of invoices that need to be issued when renting an office

According to the provisions of Clause 1, Article 3 of Circular No. 39/2014/TT-BTC: Invoice is defined as a type of document prepared by the seller to record information about sales or service provision according to the provisions of the Law. Current law.

Accordingly, businesses when conducting sales or providing services need to clearly understand the following basic types of invoices:

1.1 Value added invoice (VAT)

Value-added invoice (also known as VAT invoice) is a type of invoice for organizations that choose to declare and calculate VAT using the deduction method when conducting the following activities:

- Activities of selling goods or providing services domestically;

- International transport activities;

- Activities of exporting goods or providing services abroad;

- Export activities into non-tariff zones and other cases are considered exports.

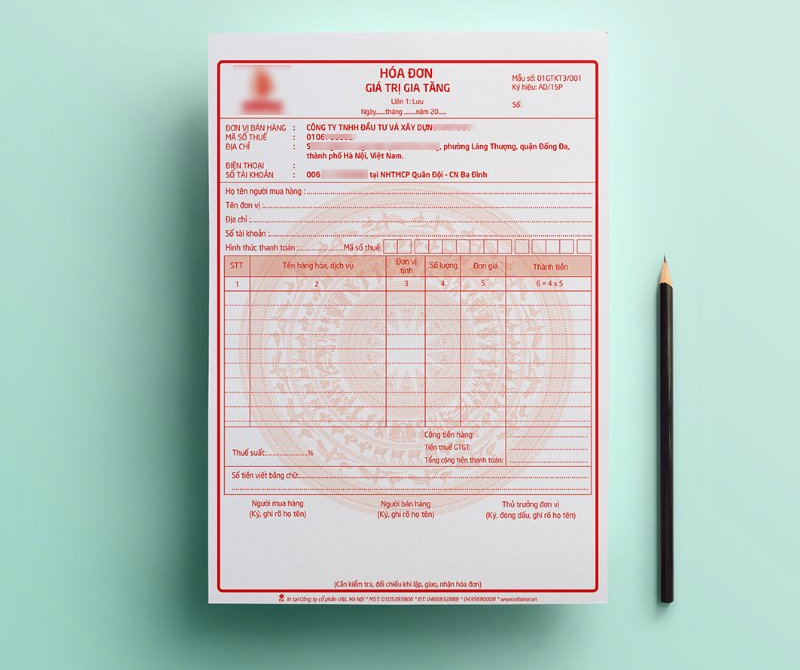

VAT invoice is an official invoice issued and applied by the Ministry of Finance of Vietnam. In fact, VAT invoices are often called red invoices – derived from the color of this invoice. The content of the VAT invoice fully records the following items:

- Name, address, tax code of seller and buyer (if any);

- List of goods and services;

- Date of transaction;

- Total value of goods and services;

- VAT calculation value

- VAT rate and VAT value.

For office rental services, the rental unit will need to clearly understand this type of VAT invoice.

1.2 Sales invoice

Not only VAT invoices but sales invoices also play an important role in providing office rental services. This is a type of document issued by the seller, requiring the buyer to pay for the items with the detailed quantity and unit price listed.

After the buyer completes payment, the seller will confirm the invoice by stamping payment confirmation. At this time, the sales invoice also acts as a receipt or receipt.

2. When is the office rental invoice issued?

Office rental invoice will be issued by the lessor. The time to issue an office rental invoice is determined to be immediately after the lessee pays the deposit or office rent according to the signed contract. Thus, after the lessee fulfills its payment obligation, the lessor will stamp to confirm that the lessee has completed its obligation.

At this time, invoices are not only documents recording information about office space for rent but are also considered legal documents used as receipts or payment receipts.

The lessor will confirm the invoice, for example by stamping payment confirmation. At this time, this sales invoice acts like a receipt or payment receipt.

With value-added invoices (VAT), the time of invoice issuance is made after the lessor completes the provision of office rental services or after collecting money (in case of pre-payment).

3. Penalty regulations when issuing invoices at the wrong time

Cases of issuing office rental invoices at the wrong time will be punished according to the provisions of Article 24 of Decree 125/2020/ND-CP as follows:

- A warning shall be imposed for acts of making invoices at the wrong time but not leading to delay in fulfilling tax obligations and having extenuating circumstances.

- A fine from 3,000,000 VND to 5,000,000 VND will be imposed for making invoices at the wrong time but not leading to delay in fulfilling tax obligations (except for the cases mentioned above).

- A fine from 4,000,000 VND to 8,000,000 VND shall be imposed for the act of making invoices at the wrong time according to the provisions of law, leading to delay in fulfilling tax obligations.

4. Characteristics of an invoice

4.1 Legality

The legality of an invoice is simply understood as compliance with the provisions of promulgated and current laws. Specifically, the issued invoice form must be issued by the Ministry of Finance of Vietnam or registered by the enterprise to issue according to the regulations of the Government and the Ministry of Finance.

In addition, businesses are also required to comply with all regulations on issuance, management and use of invoices. Fake invoices or invoices created by businesses without notification of issuance are not accepted. Therefore, units operating in the field of office leasing need to pay attention to the legality, not only for invoices but also for all papers and documents.

4.2 Reasonableness

In addition to complying with the correct time of issuing office rental invoices, the content of the invoice must also ensure reasonableness. Accordingly, the contents on the office rental invoice need to be specified with the most detailed information. And especially, it must correspond to the business activities of the enterprise unit, be able to prove and explain reasonably.

4.3 Eligibility

Office rental invoices also need to ensure validity and fully meet the principles and regulations on recording information on invoices. Accordingly, it is necessary to avoid common mistakes such as:

- Fill in or print incorrect information about invoice date, company name, tax code, company address, etc.

- There is a discrepancy between the information on the invoice such as quantity, unit price, amount, tax rate, etc. compared to the actual record.

- Missing or incorrect signature, full name of seller/buyer or tenant/lessor on the invoice.

- Optionally use ink on invoices such as pencil ink, red ink or faded ink.

- The invoice does not have the confirmation stamp of the rental/selling unit.

5. Instructions on how to write office rental invoices

Invoices are not only an important part of business operations but also a legal document that ensures the business has fully complied with tax regulations. In this section, let’s learn with Maison Office about how to write a standard office rental invoice!

5.1 Ensure criteria are prescribed by law

When issuing value-added invoices, accountants need to ensure compliance with the principles specified in Clause 1, Article 16 of Circular 39/2014/TT-BTC as follows:

- VAT invoices must be issued when businesses carry out sales activities or provide services, including cases where businesses sell sample goods, advertising goods, promotions, etc.

- The content of the VAT invoice must be consistent with the economic transaction arising.

- Invoices must not be erased or corrected; Only use one color of ink, do not use red ink and must be indelible ink; Numbers and letters are written continuously, without interruption, without overwriting existing words and crossing out blank spaces (if any).

- A VAT invoice is made once into many copies, of which copy 1 is used for the seller and copy 2 is used for the buyer.

- VAT invoices must be drawn continuously from small to large numbers.

5.2 Common errors when issuing invoices

During the process of issuing office rental invoices, there are some basic errors in invoice content that businesses need to avoid as follows:

- Leave blank or forget to write the VAT invoice date;

- Entering the wrong name, address or tax code of the purchasing unit;

- Do not cross out empty tax code boxes on the invoice;

- Incorrectly recording the unit price and amount on the invoice compared to the actual goods traded;

- The amount in numbers and the amount in words do not match;

- Do not cross out the blank parts or cross out all the blank parts in the description, quantity, unit price and amount sections on the invoice. If not completed, it will easily lead to inserting additional content that distorts the information on the invoice.

- Entering incorrect or blank VAT rate numbers;

- Do not cross out the VAT rate box for goods and services not subject to VAT;

- The currency listed on the invoice is not Vietnam Dong;

- There is no company stamp confirmation;

- The invoice lacks the buyer’s signature when purchasing directly;

- Using invoice ink that does not comply with regulations, such as: pencil ink, red ink, faded ink, etc.

- Miscalculating numbers about: quantity, unit price, amount, tax rate, tax amount,…

6. A few important notes when issuing office rental invoices

It can be seen that in reality, issuing office rental invoices can encounter many basic errors. Therefore, to ensure correct invoice content, businesses need to note the following:

- When filling in information about the buyer or information about the purchased goods, the seller needs to carefully and accurately check the information before recording it on the invoice.

- Any blank or redundant sections must be crossed out and not left out to avoid adding additional information that distorts the invoice content.

- Before delivering the invoice to the buyer, the seller or accountant must once again check the information written on the invoice, the seller’s signature, the stamp and the signature of the business representative.

Determining when to issue office rental invoices is very important because it affects the tax declaration and payment of businesses. In addition, businesses also need to clearly understand the types of invoices and principles for declaring invoices fully and accurately. Hopefully the above article has brought you useful knowledge in the process of providing office rental services!

See more:

Editor and content team manager at Maison Office.

With over 5 years of experience in consulting and extensive content editing in the real estate services and interior design field. Sharing valuable information with customers, partners, and attracting millions of views.