How To Set Up A Company In Vietnam – A Complete Guide

Setting up a company in Vietnam gives foreign investors access to a fast-growing market with competitive costs and strategic advantages. However, navigating the legal framework requires careful planning. This guide provides a step by step setup company in Vietnam process, covering entity types, legal requirements, and post-registration tasks to ensure a smooth, compliant business setup in Vietnam.

|

|

Table of Contents

Step by step process to set up a company in Vietnam

When setting up a business in Vietnam, foreign investors must follow specific regulatory requirements and a structured process. Understanding each step ensures a smooth and fully compliant Vietnam business registration.

Step 1: Determining company structure, ownership and business line

The first step to open a foreign company in Vietnam is deciding the appropriate company structure and ownership model. Foreign investors typically choose:

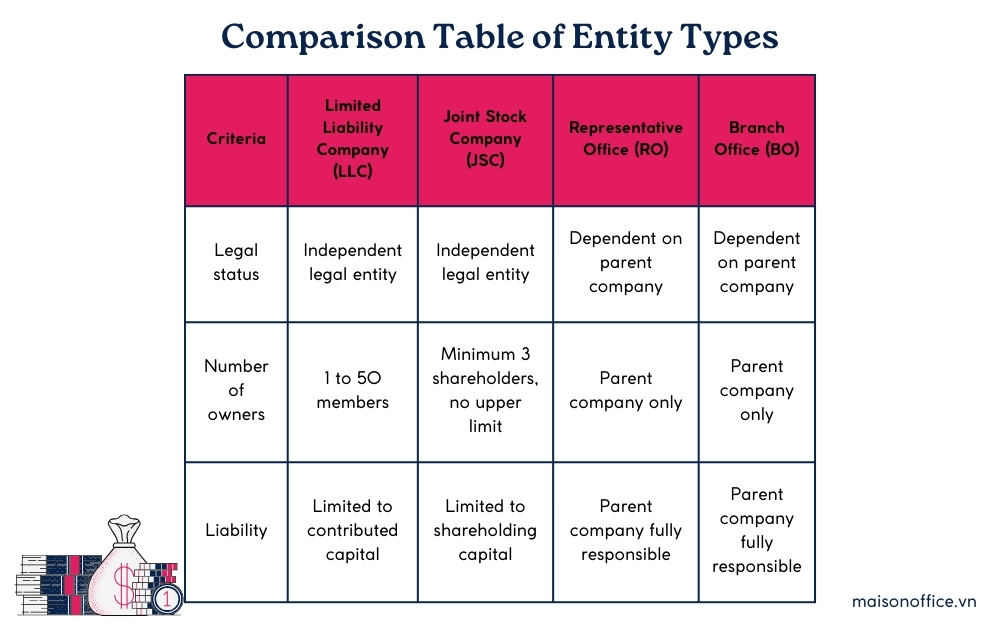

- Limited Liability Company (LLC): Flexible management structure, limited liability, ideal for small to medium-sized businesses.

- Joint Stock Company (JSC): Suitable for larger businesses requiring multiple shareholders, capital flexibility, and potential listing.

- Representative Office or Branch office: Depending on scope and intended business activities.

Selecting the correct business line (industry and business activities) is crucial, as it determines licensing requirements, capital contributions, and whether pre-investment approvals are necessary.

See more:

Step 2: Pre-investment approval

Certain investment projects or business lines in Vietnam require pre-investment approval from relevant authorities before proceeding, especially those in critical sectors such as finance, healthcare, real estate, education, and infrastructure. Industries deemed sensitive or having significant socio-economic impacts may also require prior approval to ensure compliance with local regulations and economic policies.

The pre-investment approval involves submitting preliminary documentation and detailed investment proposals outlining project feasibility, economic impact, and compliance with Vietnamese policies.

Step 3: Investment registration certificate application

The next crucial step in opening a business in Vietnam is obtaining an Investment Registration Certificate (IRC) from the Department of Planning and Investment (DPI). The IRC authorizes foreign investors to invest and operate legally in Vietnam.

Typical requirements for IRC application include:

- Investor identification documents (passport or corporate documents).

- The investment proposal clearly describes business lines, objectives, scale, capital, and implementation schedule.

- Financial capability evidence (bank statements, audited reports).

- Lease agreement proving a legal business address in Vietnam.

IRC issuance generally takes 15–20 working days after submitting complete and accurate documentation.

Step 4: Enterprise registration certificate application

After obtaining the IRC, the investor proceeds to apply for an Enterprise Registration Certificate (ERC). The ERC formally establishes the company as a legal entity in Vietnam, allowing commencement of business activities.

Documentation required typically includes:

- IRC copy and supporting documents.

- Company charter (Articles of Association).

- Declaration of company management structure.

- List of members/shareholders and their contributions.

The ERC is typically issued within approximately 5–7 working days upon successful submission.

Step 5: Post-licensing procedures

Once both the IRC and ERC are issued, several mandatory post-licensing procedures must be completed to fully operationalize the business:

- Company seal carving: Create the official company seal and notify local authorities.

- Bank account opening: Open a corporate account at a licensed bank in Vietnam.

- Charter capital contribution: Complete registered capital contributions within 90 days from ERC issuance.

- Labor registration: Register employees with labor and tax authorities, and enroll in social insurance.

- Business license tax payment: Pay annual license tax within 30 days of ERC issuance.

- Public announcement of company establishment: Publish official announcement on the National Business Registration Portal within 30 days.

General requirements for setting up a company in Vietnam

When starting a business in Vietnam, compliance with legal requirements is essential for a seamless registration process.

Charter capital

Charter capital is the registered capital contribution when setting up a company in Vietnam. While most sectors do not have a minimum capital requirement, certain industries (e.g., finance, education, real estate) impose specific thresholds.

Key considerations for charter capital:

- Investment scale: The declared capital should align with the company’s business activities and operational needs.

- Legal and financial standing: Sufficient capital enhances credibility with partners, clients, and financial institutions.

- Contribution timeline: Investors must contribute the full charter capital within 90 days from the issuance of the Enterprise Registration Certificate (ERC).

- Adjustments: Companies can increase charter capital at any time, but reducing it requires regulatory approval.

Choosing an appropriate charter capital amount ensures financial stability and long-term business success in Vietnam.

Legal representative

A legal representative is mandatory for all Vietnam business registration processes. This role oversees contract signing, regulatory compliance, and corporate governance.

Key requirements for a legal representative:

- Residency requirement: At least one legal representative must reside in Vietnam. If the company has multiple legal representatives, at least one must be present in the country to handle legal matters.

- Responsibilities: The legal representative is accountable for tax compliance, financial reporting, labor obligations, and general corporate governance.

- Multiple legal representatives: Companies can appoint more than one legal representative to share responsibilities and reduce operational risks.

Appointing a qualified and reliable legal representative is crucial for maintaining smooth business operations and ensuring compliance with Vietnamese corporate laws.

Required documents to set up a company in Vietnam

When establishing a foreign company operating in Vietnam, investors must prepare key documents to comply with local regulations. These documents ensure a smooth business setup in Vietnam and legal compliance with local authorities.

Passports or corporate registration certificates of investors

For individual investors, a notarized copy of their passport is required, while corporate investors must provide a legalized copy of their company’s registration certificate from their home country. These documents are essential when looking to open new company in Vietnam and must be properly authenticated.

Proof of financial capacity

Proof of financial capacity includes recent bank statements or audited financial reports demonstrating the investor’s ability to contribute charter capital, ensuring credibility and financial stability for business operations. Providing solid financial proof is crucial when planning to open foreign company in Vietnam and ensures smooth approval from authorities.

Investment proposal

A detailed business plan outlining:

- Business activities and objectives.

- Estimated operational scale.

- Registered capital and investment timeline.

Required for Investment Registration Certificate (IRC) issuance.

Legalized or notarized documents

Foreign-issued documents must be notarized, translated into Vietnamese, and legalized by the Vietnamese embassy or consulate in the investor’s home country. Ensuring proper legalization is a key step in opening a foreign company in Vietnam and avoiding delays in the registration process.

→ Looking for the right workspace after registering your company? Read our guide on How to find office in Vietnam: Everything you need to know to make the best choice for your business.

FAQs about setting up a company in Vietnam

-

Can foreigners fully own a company in Vietnam?

Foreign investors can establish and fully own LLCs or JSCs in most sectors. However, certain industries have specific foreign ownership limits or conditions outlined by Vietnamese law.

-

How long does it take to start a business in Vietnam?

Typically, the process takes approximately 4-6 weeks for a standard LLC or branch office, and about 6-8 weeks for a JSC. Timelines can vary based on the accuracy and completeness of the documentation provided.

-

Is there a minimum investment capital requirement?

Vietnamese law generally does not impose minimum capital requirements for most business sectors. However, certain regulated industries such as finance, real estate, and education have mandatory minimum investment levels.

By following this step by step setup company in Vietnam guide, understanding the set up a company in Vietnam, from choosing the right structure to meeting legal requirements, ensures a smooth market entry. With a growing economy and business-friendly policies, Vietnam offers significant opportunities. By ensuring compliance and a strategic setup, businesses can achieve long-term success in this dynamic market.

After establishing your company, choosing the right workspace is essential for smooth operations. Let Maison Office — your trusted commercial leasing agent in Vietnam — help you find the perfect office for lease in Ho Chi Minh City or office for lease in Hanoi to match your business needs.